Strong capital generation reflecting solid business performance

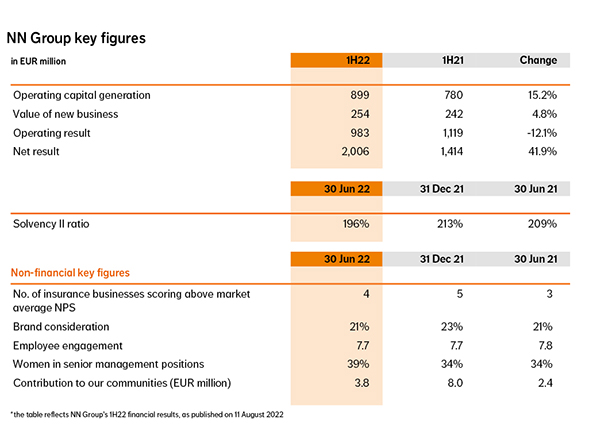

NN Group’s operating capital generation increased to EUR 899 million from EUR 780 million in the first half of 2021, reflecting a higher contribution from Netherlands Life, Japan Life and Insurance Europe partly offset by a lower contribution from Banking, Netherlands Non-life and the sale of NN Investment Partners (NN IP)

Operating result of EUR 983 million versus EUR 1,119 million in the first half of 2021, mainly reflecting the impact of the February storm in the Netherlands and the sale of NN IP

Net result of EUR 2,006 million, up from EUR 1,414 million in the first half of 2021, largely driven by the gain on the sale of NN IP

Good commercial momentum

Value of new business of EUR 254 million, up 5% from the first half of 2021, primarily due to higher sales at Netherlands Life

NN Bank and Woonnu originated EUR 4.9 billion of new mortgages in the first half of 2022

Net inflows of EUR 0.9 billion in the Defined Contribution pension business in the Netherlands

Resilient balance sheet; delivering attractive capital returns to shareholders

NN Group Solvency II ratio decreased to 196% versus 213% at 31 December 2021, mainly reflecting the deduction of capital flows to shareholders and the negative impact of market movements, partly offset by operating capital generation

Cash capital position at the holding increased to EUR 2,467 million from EUR 1,998 million at 31 December 2021, reflecting the proceeds from the sale of NN IP and free cash flow to the holding, partly offset by capital flows to shareholders, repayment of senior debt and amounts paid for acquisitions

2022 interim dividend of EUR 1.00 per ordinary share or approximately EUR 294 million

Continued focus on customers, employees and society

Customer satisfaction: 4 of our businesses scoring an above market average Net Promoter Score

Women in senior management positions increased to 39%, reflecting an extended scope of the target group to further improve on our gender diversity ambition

Target to invest an additional EUR 6 billion in climate solutions by 2030, EUR 625 million committed

Statement of David Knibbe, CEO

‘Today we are reporting strong capital generation for the first half of 2022, and we are on track to deliver on our financial and other strategic targets. These results were achieved against the backdrop of a turbulent period with major geopolitical developments and the resulting impact on the macro-economic environment, such as the sharp rise in inflation as well as significant volatility in financial markets. The impact of this turbulence on our business performance has been limited, demonstrated by the strong increase of capital generation, mainly driven by the Dutch life business as well as our international insurance businesses. The market volatility did impact our Solvency II ratio, specifically the widening of Dutch mortgage spreads and lower equity markets. Our Solvency II ratio decreased from 213% to 196% at 30 June 2022 as the strong operating capital generation of EUR 899 million in the first half of the year was offset by the deduction of the interim dividend and the EUR 1 billion share buybacks that we are currently executing, as well as the impact of market movements. At the same time our capital generation and investment returns are expected to continue to benefit from this higher spread environment and current interest rate levels.

In the first half of 2022, we continued to focus on our customers, employees and society, as measured against the non-financial targets of our strategy. We are there for our customers when it matters most. In the Netherlands, we supported them throughout the severe February storm. We increased our customer service capacity, enabling us to adequately handle the increased number of claims, while we also provided tips on how to prevent damage to properties. Further improving our customer experience continues to be a key priority.

The ongoing conflict in Ukraine has had severe humanitarian consequences in the region. As a large insurer active in Central and Eastern Europe, NN has provided multiple forms of support to help those affected. For example, we recently extended our core offering to provide medical care services to refugees in Poland, Slovakia and Hungary. The direct impact of the conflict on our business activities in the region continues to be limited.

As part of our ambition to achieve a net-zero proprietary investment portfolio by 2050, we aim to invest an additional amount of at least EUR 6 billion in climate solutions by 2030. Together with CBRE Investment Management, we launched a Positive Impact Programmatic Venture with the aim to build sustainable and affordable housing in the Netherlands.

(download the full Press Release)

Operating capital generation in the first half of 2022 was EUR 899 million, mainly reflecting a higher contribution from Netherlands Life as well as Japan Life and Insurance Europe, partly offset by a lower contribution from Banking, Netherlands Non-life and Asset Management, because of the sale of NN Investment Partners (NN IP).

The operating result was EUR 983 million, compared with EUR 1,119 million in the first half of last year, mainly reflecting the impact of the February storm and the sale of NN IP.

The storm resulted in an impact of EUR 86 million (net of reinsurance), mainly in the Netherlands Non-life segment. In Netherlands Non-life, we furthermore strengthened our reserves as a result of higher inflation. In combination with favourable claims development on prior accident years in P&C and higher underwriting results in D&A, the overall combined ratio continued to be solid at 96.1%.

Compared with the first half of 2021, NN Group’s value of new business was up almost 5%, mainly driven by a higher volume of new pension contracts in the Netherlands. Net inflows in Assets under Management DC amounted to EUR 0.9 billion, at Netherlands Life in the first half of 2022. Sales remained resilient across the group in a more challenging environment. Sales at Insurance Europe were slightly down compared with last year. In Japan, protection sales have been stable despite negative currency impacts.

NN Bank and Woonnu originated EUR 4.9 billion of mortgages in the first half of the year. Customer mortgage rates have started to increase following the rise in market rates and as a result we saw margins on new origination increasing. With an average Loan-to-Value ratio of 55% and low historical loan losses, this is a good quality asset class.

The operating result for the current period includes one quarter for the asset management business, following the completion of the sale of NN IP to Goldman Sachs in April 2022. We also completed the acquisition of MetLife’s businesses in Greece and Poland in January and April, respectively. The contribution of these businesses to results will start to come through mainly in the second half of the year. In the Netherlands, at NN Life we recently completed the acquisition of ABN AMRO Verzekeringen’s life insurance subsidiary.

We remain well positioned to benefit from the long-term growth trends in our markets and to meet our financial and other strategic targets. Our resilient balance sheet, high quality investment portfolio and our strong underlying business performance, give us confidence that we can continue to navigate the current market conditions.’

Delivering on our strategic commitments

At NN, we help people care for what matters most to them. Our purpose reflects the kind of company we aspire to be: a company that delivers long-term value for all stakeholders. Our ambition is to be an industry leader, known for our customer engagement, talented people, and contribution to society. To realise our ambition, we identified five strategic commitments, with all parts of our business contributing.

Customers and distribution – Enhancing customer experience through new partnerships and initiatives

In preparation for the new Dutch pension agreement, we invested in digital solutions to support employers and employees navigate the changes. BeFrank, our online pension administrator, developed an easy-to-use tool that shows employers what they need to change in their employees’ pension scheme and how it affects individual pensions. Employers can use the tool, together with their advisors, to make the right choices for their employees’ future pension. In addition, Nationale-Nederlanden updated its ‘mijn.nn Financial Future’ portal to enable customers to include data from other pensions schemes and their bank accounts. This gives customers a comprehensive overview of their expected future income, enabling them to better prepare for their financial future.

NN Slovakia became the majority shareholder of Finportal, one of the fastest growing distribution companies in the Slovakian financial market with more than 2,000 financial advisors and highly advanced digital solutions. This investment will give NN Slovakia new opportunities in the areas of digital solutions and customer service.

NN Life Japan introduced automated accounting for owners of small and medium-sized enterprises (SMEs). To help navigate the complex accounting procedures for corporate-owned life insurance (COLI), customers and agents can now easily find documents for accounting purposes, any time and in just a few clicks. The service aims at improving the customer experience and making the accounting process easier on them.

We also continued our efforts to reach customers by offering our products through existing customer engagement platforms. Nationale-Nederlanden expanded its partnership with motorhome rental platform Indie Campers to France and Germany, the biggest camper destinations in Europe. As a result, Nationale-Nederlanden now offers on-demand rental insurance for customers that share their campervan with other customers, in five countries.

Products and services – New protection products and services to meet customers’ evolving needs

We continued our efforts to meeting our customers’ evolving needs, with new and improved products and services. NN Romania, in partnership with ING Bank, launched an insurance product offering protection in case of unemployment, full or partial disability due to illness or accident, and extended medical leave due to incapacity to work. The product is available to customers who receive their salary in an ING Bank account and offers three levels of protection, depending on the customers’ needs. It also includes a ‘Back to Work - Unemployment Assistance’ package, supporting customers in finding a new job.

NN Life Japan partnered with IT solution provider, Writeup Co. Ltd., to launch a new one-stop service that allows SME owners to easily find grants and subsidies their company is eligible for and the expected amounts. In addition, SME owners that are NN policyholders can receive free on-line consultation to learn more about the grants and subsidies, and a 10% discount on the application assistance service, if they require professional support to make the applications.

In the Netherlands, we continued to roll out the Human Capital Planner, an online data and services platform which enables advisors and employers to have fact-based conversations with their employees about their pension plans and investments. To date, 12,000 Dutch employers and 600 advisors are using the planner, which was expanded this year to include ‘Pension Pulse’, a tool that encourages employees to research their pension, complete their risk profile and ask questions about their pension.

As part of our efforts to invest in preventative solutions, our Dutch Non-life business has piloted a new Smart Sensors service looking into whether electrical fires can be prevented by using data from sensors. This is a great added value service for customers in sectors with a high fire risk, such as hospitality and agriculture.

People and organisation – Supporting our people by promoting inclusive working conditions

We nurture a culture aimed at empowering our colleagues to be their best. As part of our efforts to support a healthy work-life balance and flexible working conditions for our employees, in the Netherlands we are initiating ‘vitality leave’ in which colleagues can take two months’ leave every five years, during which they receive reduced salary but continue pensions accrual.

We continued our efforts to become a more diverse and inclusive workplace. For this reason, we introduced the ‘You matter leave’, a tailormade leave for colleagues in the Netherlands, for example to be used to mourn a loved one or to receive a gender transition treatment. We also published our first Diversity & Inclusion (D&I) report, which includes insights and examples from across our businesses. NN Romania signed the Romanian Diversity Charter.

To further improve and strengthen the impact of our gender diversity ambition, we extended the scope of our target to have at least 40% women in senior management positions by 2023. As of 2022, in addition to the Management Board (MB) and managerial positions reporting directly to the MB, this target group includes all senior managerial positions reporting in our business units.

Especially in current tight labour markets, we are pleased to see the engagement of NN colleagues remaining high at 7.7 in the first half of 2022 (and stable compared with the second half of 2021). The results show colleagues feel empowered to fulfil their role, they feel valued, and experience room for professional development.

NN Group was included in the 2022 Bloomberg Gender Equality Index (GEI) for the fourth time in a row. The index recognises companies’ efforts to report transparently on gender equality, and on topics such as female leadership, inclusive culture, pro-women brand, equal pay and gender pay parity. In addition, for the fourth time, all business units within NN International Insurance have been certified as Top Employer 2022, scoring above benchmark with progress in the areas of Diversity & Inclusion, Work Environment, and Learning.

Financial strength – Maintaining a strong balance sheet and continuing to generate attractive returns in volatile markets

We aim to maintain a strong balance sheet and generate attractive financial returns for shareholders. Despite the macro-economic and financial markets turmoil, we increased our operating capital generation in the first half of 2022. The shift to higher-yielding assets in 2020 and 2021 is generating higher returns on our conservative asset portfolio. Our Solvency II ratio stood at 196%, our cash capital position was EUR 2,467 million and with a leverage ratio of 21.7%, we have ample financial flexibility.

Society – Continuous support and investment in our communities

We continued to support our communities through various initiatives and partnerships in the areas of Inclusive economies, Healthy and safe living, and Sustainable planet. In May 2022, NN Group organised a company-wide volunteer week, the ‘Your community matters week’, with 2,613 colleagues participating. Overall, we organised 45 volunteering activities that reached over 7,500 people and supported 42 charities.

On a local level, Nationale-Nederlanden in Spain partnered with ‘Unoentrecienmil Foundation’, which promotes research projects to find a cure for leukaemia. The collaboration starts with an initiative to incorporate sports therapy into children’s treatment and the construction of a physical exercise research unit. NN Turkey launched a breast cancer awareness project, supporting early diagnosis. The programme involves training sessions on breast cancer, access to cancer screening and psychological support to breast cancer patients. In ten months, the project has reached 900 women in five cities. In the Netherlands, we extended our partnership with non-profit organisation JINC to launch a new ‘Networking for Work’ project aimed at supporting youngsters with their entry into the labour market.

NN Group published its first Community Investment Report, a comprehensive overview of the initiatives we support as part of our strategic commitment to contribute to society. The report showcases how we put our resources, expertise and networks to use for the advancement of our communities in the countries we operate. The report will be published annually.

In the first half of 2022, NN Group’s total contributions to communities was EUR 3.8 million, including more than EUR 2.8 million in cash donations and more than EUR 670,000 in monetised volunteer hours.

NN Bank issued a EUR 500 million inaugural green covered bond with a maturity of 10 years and a coupon of 1.87%. This was the first ever green covered bond issued by a Dutch Bank.

(download the full Press Release)

Press call

David Knibbe (CEO), Annemiek van Melick (CFO) and Bernhard Kaufmann (CRO) will host a press call to discuss the 1H22 results at 07:30 am CET on Thursday 11 August 2022. Journalists can join the press call at +31 (0) 20 795 2758 (NL). The operator will request the following Conference ID: 3828646.

Analyst and investor call

David Knibbe (CEO), Annemiek van Melick (CFO) and Bernhard Kaufmann (CRO) will host an analyst and investor conference call to discuss the 1H22 results at 10:30 am CET on Thursday 11 August 2022. Members of the investment community can follow the live audio webcast on NN Group - Investors (nn-group.com).

Analysts can participate in the Q&A using the following dial-in numbers:

+31 (0) 20 795 2758 (the Netherlands)

+44 800 260 6466 (UK)

+1 800 715 9871 (US)

Financial calendar

- Investor Update: 17 November 2022

- AGM: 2 June 2023

Publication 2H22 results: 16 February 2023

Additional information on www.nn-group.com

NN Group 1H22 Financial Supplement, NN Group 1H22 Analyst Presentation, NN Group Company Profile and NN Group ESG presentation

NN Group 30 June 2022 Condensed consolidated interim financial information

Photos of NN Group executives, buildings and events are available for download at Flickr

-

NN Group is an international financial services company, active in 11 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, banking and investments to approximately 18 million customers. NN Group includes Nationale-Nederlanden, NN, ABN AMRO Insurance, Movir, AZL, BeFrank, OHRA and Woonnu. NN Group is listed on Euronext Amsterdam (NN).

-

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation).

NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. Condensed consolidated interim financial information for the period ended 30 June 2022.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) the effects of the Covid-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which NN Group operates, on NN Group’s business and operations and on NN Group’s employees, customers and counterparties (3) changes in performance of financial markets, including developing markets, (4) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (5) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (6) the frequency and severity of insured loss events, (7) changes affecting mortality and morbidity levels and trends, (8) changes affecting persistency levels, (9) changes affecting interest rate levels, (10) changes affecting currency exchange rates, (11) changes in investor, customer and policyholder behaviour, (12) changes in general competitive factors, (13) changes in laws and regulations and the interpretation and application thereof, (14) changes in the policies and actions of governments and/or regulatory authorities, (15) conclusions with regard to accounting assumptions and methodologies, (16) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (17) changes in credit and financial strength ratings, (18) NN Group’s ability to achieve projected operational synergies, (19) catastrophes and terrorist-related events, (20) adverse developments in legal and other proceedings and (21) the other risks and uncertainties contained in recent public disclosures made by NN Group.

Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and, NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.