Robust capital position

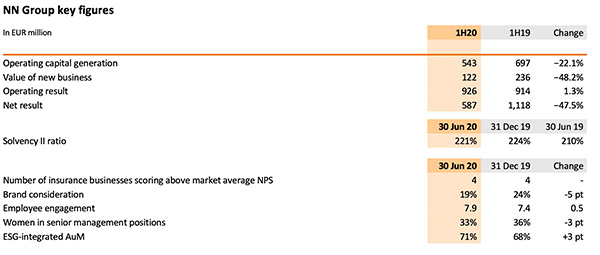

NN Group Solvency II ratio of 221% versus 224% at the end of 2019; the Solvency II ratio before deduction of the interim dividend and EUR 183 million of share buybacks in the first half of 2020 was 231%

Cash capital position at the holding decreased to EUR 1,315 million from EUR 1,989 million at the end of 2019, reflecting cash outflows of EUR 1,132 million including the consideration paid for the acquisition of VIVAT Non-life, the redemption of EUR 300 million senior debt and the repurchase of own shares, partly offset by remittances from subsidiaries to the holding

2020 interim dividend of EUR 2.26 per ordinary share or approximately EUR 705 million, which comprises the amount of the suspended final dividend plus the regular interim dividend amount

Resumption of share buybacks for the remaining amount of EUR 67 million of the original EUR 250 million programme

Strong results in current economic environment

Operating capital generation decreased to EUR 543 million from EUR 697 million in the first half of 2019, reflecting lower interest rates and the impact of COVID-19 restrictions

Operating result increased to EUR 926 million from EUR 914 million in the first half of 2019, which benefited from EUR 67 million of private equity dividends, while the current half-year includes EUR 16 million of private equity dividends and non-recurring benefits

Limited negative impact of COVID-19 of around EUR 30 million in the first half of 2020

Net result of EUR 587 million, down from EUR 1,118 million in first half of 2019, which benefited from positive revaluations

Further cost reductions of EUR 21 million in the first half of 2020; total cost reductions achieved to date of EUR 381 million versus the full-year 2016 administrative expense base

The value of new business was EUR 122 million, down from EUR 236 million in the first half of 2019, reflecting lower sales in Japan and Insurance Europe

Statement of David Knibbe, CEO

‘Despite the current turbulent economic environment, we present a solid set of results for NN Group today. We were able to respond quickly to the COVID-19 pandemic by ensuring continuity of our business and adapting to the changing needs of our customers, employees and other stakeholders. Our Solvency II ratio remains strong at 221% and our balance sheet is resilient, with a strong cash capital position of EUR 1,315 million at the end of June 2020.

The decision to suspend the 2019 final dividend and share buyback programme in April followed the recommendations of the European and Dutch regulators in response to the COVID-19 crisis and the uncertainty about how that would develop. However, it was always our intention to make those distributions to shareholders when the time was right and therefore we now announce that we are resuming the share buyback programme and will pay an interim dividend of EUR 2.26 per ordinary share, comprising the combined amount of the suspended final dividend and the regular interim dividend.

Our focus is now on operating capital generation (OCG) and our commitment to grow OCG to mid-single digit over time. The OCG in the first half of 2020 was EUR 543 million, reflecting the impact of low interest rates and

COVID-19. We are reporting an operating result for the first half-year of EUR 926 million, an increase of 1.3% compared with the same period last year. The impact of the pandemic on our operating result was limited at around EUR 30 million, while sales and value of new business were impacted by COVID-19 restrictions and the tax regulation change in Japan. In Netherlands Life we accelerated the shift to higher-yielding assets and we took various expense initiatives at Insurance Europe to maintain efficiency. And in Japan we successfully kept surrender rates down, for example by offering policy loans.

In the first six months of the year almost 15 thousand new mortgages for a total amount of EUR 4.4 billion were originated at NN Bank, compared with 12.5 thousand mortgages and EUR 3.7 billion in the first half of 2019. Total Assets under Management at NN IP increased to EUR 285 billion, compared with EUR 276 billion at the end of 2019. Our asset manager attracted net Third-Party assets of EUR 3.5 billion in the first half-year, mainly in Fixed Income and multi-asset strategies as well as in its Dutch residential mortgage fund. The pandemic understandably put some pressure on our customer engagement scores (NPS), while our employee scores improved significantly. Employees indicate they value the measures taken by the company to safeguard their well-being and facilitate working from home.

We reduced administrative expenses by a further EUR 21 million in the first half of the year, bringing our total expense reduction to EUR 381 million at the end of the first half of 2020. After completing the acquisition of VIVAT Non-life on 1 April, we have started the process of integrating the business, for example by redirecting new business to NN platforms and cooperating closely with our intermediaries on migrations. Overall Netherlands Non-life performed well with a combined ratio of 94.9% for the first half of 2020. We are taking measures to improve the performance of the Netherlands Non-life business, especially at Disability & Accident.

During our Capital Markets Day in June, we presented our strategy as well as new targets for the Group and the individual business segments. It is our aim to create value for the benefit of all stakeholders. Our broader responsibility to society is reflected in our non-financial targets that, for instance, help to accelerate the transition to a low-carbon economy by transitioning our proprietary investments to net-zero carbon emissions by 2050. This commitment to align with the Paris Agreement follows earlier steps, such as the phase-out strategy of thermal coal-exposed proprietary investments by 2030, the carbon footprint analysis, and the climate-related scenario analysis. At the end of June 2020, the percentage of our total Assets under Management where environmental, social and governance (ESG) factors are integrated in the investment process, was 71 percent.

With our priority to maintain a strong balance sheet, and the strategic actions we are taking to achieve resilient and growing long-term capital generation, we are well-positioned to navigate through volatile markets, drive profitable growth and deliver attractive capital returns going forward.’

(download the full Press Release)

Business update

At NN, we help people care for what matters most to them. Our purpose reflects the kind of company we aspire to be: a company that delivers long-term value for all stakeholders. Our ambition is to be an industry leader, known for our customer engagement, talented people, and contribution to society. To realise our ambition, we identified five strategic commitments, with all parts of our business contributing.

Customers and distribution

Responding to the coronavirus pandemic, we enabled our sales agents to move sales processes online in all markets to serve our customers remotely. We also changed the terms of some of our products to support customers unable to pay their insurance premiums. NN Bank increased the use of payment breaks for both mortgage and consumer loan customers in financial distress. Nationale-Nederlanden announced a partnership with MKB-Nederland, the largest entrepreneurs’ organisation in the Netherlands, through which experts share knowledge, experience and solutions to help Dutch entrepreneurs.

Nationale-Nederlanden and BeFrank, which have a leading position in the group pensions market in the Netherlands, are engaging in constructive dialogues with all relevant parties involved in the new Dutch pension agreement to ensure a sustainable solution for Dutch customers in the long term.

In our efforts to make our operations more efficient and reduce IT complexity, the migration to the target retail protection platform in NN Belgium Life is complete for brokers and the legacy system decommissioned.

Products and services

Several new protection products were launched in the first half of 2020, such as NN Orange Risk in the Czech Republic, a standard term risk product offering a variety of coverages and options for discounts. NN Orange Risk brings together best practices following the integration of NN and Aegon and is offered through brokers, and later in the year, through tied agents and our banking partners. In Turkey, we introduced Return of Premium, a long-term life protection product with a partial premium return at maturity, subject to the insured person’s survival. Accidental death and critical illness are provided as riders and the policy duration is offered from three to five years.

In Poland, we launched a diabetes insurance, as a supplement to life insurance contracts. This is a unique product in Poland, allowing people already suffering from diabetes to take out an insurance product.

NN Non-life successfully launched a new state of the art target platform in Belgium in close collaboration with bancassurance partner ING to offer car insurance and other products.

In March, NN Investment Partners (NN IP) and its strategic partner China Asset Management Co. Ltd. (ChinaAMC) together launched an inaugural ESG-integrated China A-Share Equities strategy. The current market developments underline the importance of integrating Environmental, Social and Governance (ESG) factors into our investment strategies, making the fund well-positioned to leverage on this opportunity.

People and organisation

We empower our colleagues to be their best and nurture a culture that supports continuous learning, collaboration, and diversity of thinking. Testament to our efforts is the Top Employer 2020 certification our Insurance International units received, which stands for excellence in HR practices and distinctive work conditions. We measure our employee engagement in our (semi) annual employee survey in which we want to hear views of our employees on how we are doing as a company, how they feel about working at NN, and how we can make our company an even better place to work. Our Employee engagement score increased from 7.4 to 7.9 in the first half of 2020.

Financial strength

We aim to maintain a strong balance sheet and generate attractive financial returns for shareholders. In the first half of 2020, we accelerated the shift to higher-yielding assets by investing in investment grade bonds, equities and Emerging Market Debt for a total amount of EUR 4.2 billion.

In May 2020, NN Life completed three transactions to transfer the full longevity risk associated with a total of approximately EUR 13.5 billion of pension liabilities in the Netherlands. This will reduce NN’s exposure to longevity risk, and consequently reduce the required capital and further strengthen NN’s capital position.

In June, NN Bank successfully launched and priced its inaugural EUR 500 million, 10-year Soft Bullet Covered bond, thereby further diversifying the Bank’s funding mix and broadening its investor base.

Society

NN IP complemented its impact investment offering through the launch of the NN (L) Corporate Green Bond fund and three thematic impact equity funds - NN (L) Health & Well-being, NN (L) Climate & Environment, and

NN (L) Smart Connectivity each seeking to tackle specific UN Sustainable Development Goals.

NN, amongst other companies, is a signatory to a statement by the Dutch Sustainable Growth Coalition, requesting the government to place sustainability at the cornerstone of the COVID-19 recovery. Following last year’s announcement that NN Group and Plastic Whale are joining forces to fight plastic waste, in April 2020

Nationale-Nederlanden Spain signed a plastic pledge to reduce the use of plastic in our offices.

(download the full Press Release)

Analyst and investor call

David Knibbe (CEO) and Delfin Rueda (CFO) will host an analyst and investor conference call to discuss the 1H20 results at 10.30 am CET on Thursday 6 August 2020. Members of the investment community can join the conference call at +31 20 531 5865 (NL), +44 203 365 3210 (UK), +1 866 349 6093 (US) or follow the webcast on www.nn-group.com.

Press call

David Knibbe (CEO), Delfin Rueda (CFO) and Bernhard Kaufmann (CRO) will host a press call to discuss the 1H20 results at 07:45 am CET on Thursday 6 August 2020. Journalists can join the press call at +31 20 531 5863 (NL).

Financial calendar

Publication 2H20 results: 18 February 2021

- AGM: 20 May 2021

- Publication 1H21 results: 12 August 2021

Additional information

- Photos of NN Group executives, buildings and events are available for download at Flickr

-

NN Group is an international financial services company, active in 20 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, investments and banking to approximately 18 million customers. NN Group includes Nationale-Nederlanden, NN, NN Investment Partners, ABN AMRO Insurance, Movir, AZL, BeFrank and OHRA. NN Group is listed on Euronext Amsterdam (NN).

-

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation). NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. Condensed consolidated interim financial information for the period ended 30 June 2020.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) the effects of the COVID-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which NN Group operates, on NN Group’s business and operations and on NN Group’s employees, customers and counterparties (3) changes in performance of financial markets, including developing markets, (4) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (5) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (6) the frequency and severity of insured loss events, (7) changes affecting mortality and morbidity levels and trends, (8) changes affecting persistency levels, (9) changes affecting interest rate levels, (10) changes affecting currency exchange rates, (11) changes in investor, customer and policyholder behaviour, (12) changes in general competitive factors, (13) changes in laws and regulations and the interpretation and application thereof, (14) changes in the policies and actions of governments and/or regulatory authorities, (15) conclusions with regard to accounting assumptions and methodologies, (16) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (17) changes in credit and financial strength ratings, (18) NN Group’s ability to achieve projected operational synergies, (19) catastrophes and terrorist-related events, (20) adverse developments in legal and other proceedings and (21) the other risks and uncertainties contained in recent public disclosures made by NN Group.

Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and, NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.