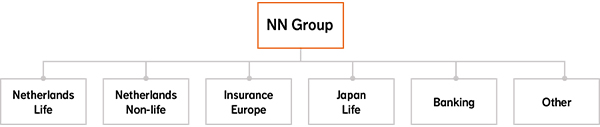

Reporting segments

With all our employees, we aim to deliver high-quality products and services to retail, SME and large corporate customers. Our business activities are structured in six reporting segments: Netherlands Life, Netherlands Non-life, Insurance Europe, Japan Life, Banking and Other.

Netherlands Life

Netherlands Life has a strong position in the Dutch pension market and offers a range of group life and individual life insurance products. It is NN Group’s largest business and primarily consists of Nationale-Nederlanden Life, AZL and BeFrank. Netherlands Life is organised by pension products and the individual life closed block. The pension product line provides group life and pension products to small and medium-sized enterprises (SME) and to large corporate clients and their employees. The individual life closed block primarily consists of individual life portfolios comprising a range of discontinued products sold prior to 2012.

Netherlands Non-life

Netherlands Non-life offers a broad range of non-life insurance products – including motor, fire, liability, transport, travel, and disability and accident insurance – to retail, self-employed, SME and corporate customers. The segment comprises Nationale-Nederlanden Non-life, the non-life results of ABN AMRO Insurance, Movir, OHRA, and the broker results related to health insurance products.

Insurance Europe

Insurance Europe primarily offers life insurance and pension products to retail, self-employed and SME customers. In Belgium, Spain and Poland, we also offer non-life insurance products, and health insurance in Greece, Hungary and Romania. The countries in which Insurance Europe is active are a mixture of mature and growth markets. Our main brands are NN and Nationale-Nederlanden (in Spain and Poland).

Japan Life

Japan Life has a strong niche position offering a range of corporate-owned life insurance (COLI) products to owners and employees of SMEs through more than 5,000 registered independent agents and 70 financial institution partners (banks and securities houses) supported by sales support offices located in 28 cities throughout Japan.

Banking

NN Bank is the banking business of NN Group. NN Bank was founded in 2011 as a Dutch retail bank. It is a fully owned subsidiary of NN Group.

In the Netherlands, NN Bank’s broad range of banking products is complementary to Nationale-Nederlanden’s (NN’s) individual life, non-life insurance products and pension propositions for retail customers. NN Bank helps customers manage and protect their assets and income through mortgage loans, (internet) savings, bank annuities, consumer lending and retail investment products. In addition, NN Bank provides mortgage administration and management services to ING Bank N.V. (former WestlandUtrecht Bank), NN Life and NN Non-life in the Netherlands, NN Belgium, and the NN Dutch Residential Mortgage Fund.

Other

The segment ‘Other’ comprises the businesses of Japan Closed Block VA, NN Re, the results of NN Group’s holding company, and other results.

Japan Closed Block VA comprises NN Group’s closed-block single premium variable annuity (SPVA) individual life insurance portfolio in Japan. These products were predominantly sold from 2001 to 2009. The total portfolio is reinsured by NN Re in the Netherlands. The portfolio is actively managed and hedged on a market consistent basis and is expected to release capital as the block runs off. The exact timing and amount cannot be predicted as it is influenced by the results of the hedge programme.

NN Re is NN Group’s internal reinsurer. It provides innovative reinsurance solutions to manage risks, optimise capital, support growth in business units, and safeguard stable and efficient hedging.

The result of the holding includes the interest paid on hybrids and debt, interest received on loans provided to subsidiaries and on cash and liquid assets held at the holding company and the head office expenses that are not allocated to the business segments.

Our business activities are structured in seven reporting segments.

Download our latest factsheets

Disclaimer

The sale of NN Investment Partners closed on 11 April 2022. As a result of the sale, Asset Management ceased to exist as an NN Group reporting segment.