NN Group reports 3Q16 results

17 November 2016 | NN Group reports 3Q16 results

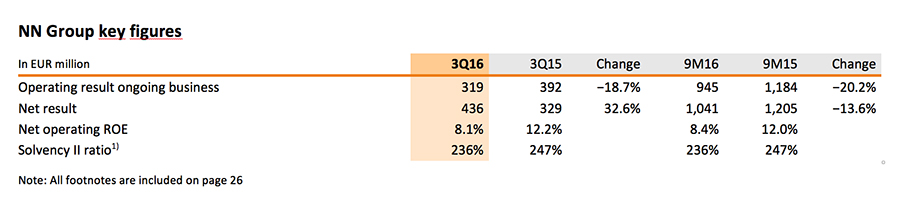

Strong capital position and net result

- Operating result ongoing business of EUR 319 million compared with EUR 392 million in 3Q15, which was supported by EUR 127 million private equity dividends versus EUR 13 million in 3Q16; excluding these, the operating result improved by 15.5%

- Net result of EUR 436 million versus EUR 329 million in 3Q15, mainly driven by higher capital gains and revaluations as well as a lower hedge-related loss for Japan Closed Block VA

- Cost savings in the Netherlands of EUR 21 million in 3Q16, bringing the expense base down to EUR 765 million

- Solvency II ratio decreased to 236% from 252% at 2Q16 primarily due to market impacts

- Holding company cash capital increased to EUR 2.4 billion driven by dividends from several units, partly offset by the payment of the 2016 interim dividend and share buybacks

Statement of Lard Friese, CEO

‘Despite the prevailing uncertain economic conditions, we continue to deliver on our targets to generate capital and improve earnings, while bringing our brand promise ‘You matter’ to life for our customers every day. We maintain a strong balance sheet, with a solvency ratio of 236%.

Given the market dynamics and the competitive operating environment, we believe there is a clear and compelling logic to bring consolidation to the Dutch insurance market. Being one of the best capitalised and less leveraged insurance companies in Europe, NN Group is well-positioned to take a significant step in this consolidation process. On 5 October, we announced our intention to make an offer to acquire all issued and outstanding ordinary shares of Delta Lloyd. We see strong merit in a combination of Delta Lloyd and the Dutch and Belgian activities of NN Group, and remain open to a constructive and substantive dialogue with Delta Lloyd to come to a recommended transaction. We consider this potential transaction to be financially and strategically compelling and beneficial to both companies’ stakeholder groups.

We take a disciplined and rational approach in executing our strategy, and regardless of the outcome of the above-mentioned process, will continue to focus on earnings improvement and free cash generation – while maintaining a strong balance sheet and solvency position. At the same time we are committed to innovating our businesses in order to keep improving our services and products to customers, and proactively respond to the trends in our sector.

Our strong customer relationships were reflected in our performance in the first nine months. In the Netherlands, NN Bank is welcoming new customers in the savings and mortgage market and growing its operating result. NN Life Japan entered into a long-term collaboration with Sumitomo Life Insurance focusing on our COLI products for small and medium-sized enterprises. New sales at Japan Life grew more than 22% year-on-year, excluding currency effects, driven by the launch of a critical illness COLI product. And in this quarter NN Investment Partners was able to attract EUR 600 million of net inflows in Third-Party assets.

NN Group has a history that stretches back more than 170 years. We have been an active member of society, involved in the lives of our customers, and doing what we do best – helping people secure their financial futures. We want to contribute to the well-being of society and have the ambition to further integrate ethical, social and environmental components into our core strategy. We feel encouraged by the improvement of our position in the ranking of the Dow Jones Sustainability Index to 77 points (out of 100), which places NN Group in the top quartile of the global insurance industry.’

(download de full Press Release)

Quarterly Business Update

NN Group´s strong financial position during the first nine months of 2016 reflects the resilience of its businesses in an environment which continues to be characterised by low interest rates and market volatility. This provides a solid foundation for executing its strategy, which is to deliver an excellent customer experience based on transparent products and services and long-term relationships. NN Group aims to help people secure their financial futures, and is committed to delivering products and services that are easy to understand and meet customers’ lifetime needs.

Transparent products and services

NN Life Japan launched a new Corporate-Owned Life Insurance (COLI) critical illness product in July, driving significant growth of new sales in the third quarter. Our Dutch Non-life business launched a marketing campaign in Belgium in the third quarter to promote its new Home and Family insurance product covering Building and Contents, as well as legal aid and liability. The product involves a fast online subscription process and initial results are encouraging. NN Hellas, our insurance company in Greece, was the first to introduce the Growing Guarantee product in July 2016. This product is less capital intensive and provides a guarantee for customers with upward potential. In the fourth quarter of 2016, this product will also be made available through NN Hellas’ bancassurance partner Piraeus Bank.

Capturing growth

The fundamental need of people to protect themselves against uncertainties will continue to drive growth in the insurance industry over the long-term. NN Group continues to adapt its businesses to optimally capture this growth potential. For example, in Hungary, NN launched a special programme for clients with maturing policies, offering them tailored advice from financial advisors. This way, NN is fostering customer relationships by recognising and rewarding long-term loyalty.

NN Hayat ve Emeklilik, our business in Turkey, is developing a new pension product to meet both customers’ needs and regulatory requirements following a new auto-enrollment pension law passed in August. Under this law, which will be effective as of 1 January 2017, all employees under the age of 45 will be enrolled in the new compulsory pension system while their employers can select a pension company. In the Netherlands, NN Bank welcomed over 7,000 new customers during the third quarter, as well as another 13,600 insurance customers through cross-selling efforts. And in this quarter NN Investment Partners was able to attract net inflows from third parties.

Multi-access distribution

NN Group serves its customers through multiple channels, comprising tied agents, bancassurance partners, brokers and direct channels. It is our aim to achieve profitable growth through multi-access distribution. In line with this strategy, NN Life Japan recently announced that it has entered into a long-term collaboration with Sumitomo Life Insurance. Sumitomo Life Insurance will sell NN Life Japan’s COLI products to Small and Medium-sized Enterprises (SMEs) through its nationwide tied agency network. The agreement also provides a framework for collaboration on potential future product initiatives.

Effective and efficient operations

NN Group aims to make its processes as efficient and effective as possible across all segments, and is sharpening its client focus tailored by type and country, increasing organisational agility. In the Netherlands, the strategy is centred around providing digital, personal and relevant services with the aim of enhancing the customer experience. As part of this strategy, Nationale-Nederlanden continues to expand its digital outreach to customers via its ‘My NN’ web portal. In the third quarter, it introduced My Mortgage Application, which makes it possible to track and trace the status of applications, and also made available online Consumer Credit and Revolving Credit applications. As a result of these digital expansions, the number of visitors on My NN has increased to 200,000 visitors on average each month.

In November 2016, our general pension fund ‘De Nationale APF’, which was set up by AZL, NN Life’s pension administrator, and NN Investment Partners received its license from DNB. De Nationale APF is an independent entity which provides an attractive solution for pension funds and employers to comply with increasingly complex pension regulations and to benefit from economies of scale.

The international business continues to focus on protection products via bancassurance channels and tied agents. In addition, sales channels are being digitalised, leading to more efficient operations. The implementation of digital solutions in the international businesses is progressing well. Following the example from Spain, Poland, the Czech Republic and Slovakia also launched paperless sales processes. This quarter, NN Hungary introduced an online client portal, NN Direkt, which is the first online client portal in the market with an audited electronic signature. NN Direkt increases the means of communication with customers, while simultaneously reducing costs.

Innovation

In July, the Dutch Non-life business launched a pilot for a new customer service called ‘prevention scan’, which provides for an independent Prevention Coach to perform a comprehensive check on a client’s house. The safety assessment by the coach is accompanied by tailor-made advice on how to improve fire safety, prevent burglary and avoid water damage. NN Non-life also offers assistance to implement these safety improvements.

Other events

Further strengthening our corporate brand, a new multi-media campaign was launched in the Netherlands during the third quarter, adopting the theme ‘There is only one like you’ (‘Er is maar een Nederlander zoals jij’). The campaign features a variety of unique individuals with their own circumstances, wishes and goals. Nationale-Nederlanden recognises this uniqueness of their customers, and knows that every person deserves personal services that suit their individual lives. After a period of two weeks the first two products were added to the campaign; Managed investments (‘Beheerd Beleggen’) and Your future income (‘Jouw inkomen later’). These new products exemplify our goal of offering services that fit each individual customer’s needs.

It is our ambition to make a positive impact on society through integrating sustainability aspects into our core activities. NN Group improved its position in the ranking of the Dow Jones Sustainability Index (DJSI). NN Group scored 77 points (out of 100), an increase of 9 points compared with 2015 mainly driven by improved scores on Tax strategy, Customer Relationship Management and Financial Inclusion. The average for the insurance sector is 50 points. The research executed by RobecoSAM helps us gain insight on areas for further improvement.

In the Netherlands, Nationale-Nederlanden signed up to a ‘green deal’ to promote car sharing, and will modify its policy terms and conditions to extend insurance coverage for car sharing initiatives. Green deals are partnerships between the Dutch government and third parties to achieve sustainability targets. The aim is to achieve 100,000 shareable cars in the Netherlands by the end of 2018.

(download de full Press Release)

Investor conference call and webcast

Lard Friese and Delfin Rueda will host an analyst and investor conference call to discuss the 3Q16 results at 09.30 am CET on Thursday 17 November 2016. Members of the investment community can join the conference call at +31 20 531 5865 (NL), +44 203 365 3210 (UK), +1 866 349 6093 (US) or follow the webcast on www.nn-group.com.

Press call

Lard Friese and Delfin Rueda will host a press call to discuss the 3Q16 results, which will be held at 11.30 am CET on Thursday 17 November 2016. Journalists can join the press call at +31 (0)20 531 5863.

Financial calendar

- Publication 4Q16 results: 16 February 2017

- Publication 1Q17 results: 18 May 2017

- Annual General Meeting: 1 June 2017

- Publication 2Q17 results: 17 August 2017

- Publication 3Q17 results: 16 November 2017

Additional information

- NN Group 3Q16 Financial Supplement, NN Group 3Q16 Analyst Presentation and NN Group 3Q16 Condensed consolidated interim accounts

- Photos of NN Group executives, buildings and events are available for download at Flickr

- NN Group profile

- Important legal information

NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 on the Dutch Civil Code.

In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. condensed consolidated interim financial information for the period ended 30 September 2016. All figures in this document are unaudited. Small differences are possible in the tables due to rounding.

Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) break-up of the euro, (4) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (5) the frequency and severity of insured loss events, (6) changes affecting mortality and morbidity levels and trends, (7) changes affecting persistency levels, (8) changes affecting interest rate levels, (9) changes affecting currency exchange rates, (10) changes in investor, customer and policyholder behaviour, (11) changes in general competitive factors, (12) changes in laws and regulations, (13) changes in the policies of governments and/or regulatory authorities, (14) conclusions with regard to accounting assumptions and methodologies, (15) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards, (16) changes in credit and financial strength ratings, (17) NN Group’s ability to achieve projected operational synergies and (18) the other risks and uncertainties detailed in the Risk Factors section contained in recent public disclosures made by NN Group.

Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and, NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason. This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.