NN Group reports 3Q19 results

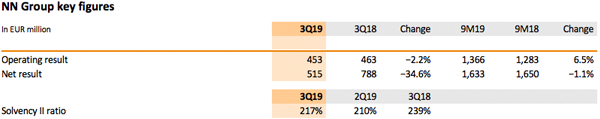

- Operating result of EUR 453 million versus EUR 463 million in 3Q18, mainly due to lower private equity and special dividends at Netherlands Life and a lower result at the reinsurance business, largely offset by higher results at Netherlands Non-life, Insurance Europe, Japan Life and Banking

- Net result of EUR 515 million compared with EUR 788 million in 3Q18, mainly reflecting lower non-operating items

- Further cost reductions of EUR 17 million in 3Q19, bringing total cost reductions achieved to date to EUR 323 million versus the full-year 2016 administrative expense base

- Solvency II ratio of 217% up from 210% at the end of 2Q19, reflecting the positive impact of operating capital generation

- Holding company cash capital of EUR 1,943 million, including EUR 285 million of dividends received from subsidiaries

Statement of David Knibbe, CEO

‘We are pleased to present NN Group’s strong results for the third quarter of 2019, reflecting a continued focus on providing our customers with value-added products and services and an excellent experience.

Looking back at the financial performance of the past quarter, most segments have reported improved results compared with the same quarter last year. Netherlands Non-life showed a good result, with a combined ratio of 94.2%. Insurance Europe, Banking and Japan Life also contributed to the result, while private equity and special dividends at Netherlands Life were lower than a year ago. We have reduced the expense base of the units in scope of the integration by a further EUR 17 million in the third quarter, bringing total cost savings to date to EUR 323 million. We have seen commercial momentum in the Netherlands, including an increased mortgage origination of EUR 2 billion at Banking and strong sales at Insurance Europe. NN IP, our asset manager, achieved inflows of new assets which contributed to bringing the total assets under management to EUR 287 billion. Total new sales of the insurance businesses were down on the third quarter of 2018, due to lower sales at Japan Life following the introduction of the new tax rules for certain COLI products.

NN Group has a strong capital position, as evidenced by a Solvency II ratio of 217% and cash capital at the holding of EUR 1.9 billion.

Customer satisfaction scores remained stable or increased to date this year. NN in the Netherlands has the highest brand consideration and preference score for pensions in the market. We aim to become even more relevant in the lives of our customers and to further improve their experience with our company, by offering them the right products and services that meet their needs and by connecting data analytics across distribution channels and sales points.

We want to play our part in enabling sustainable progress in society. We are proud that NN Group has been included in the Dow Jones Sustainability Indices for the third year in a row, in recognition of our performance on set economic, environmental and social indicators.

Looking ahead, we have decided to move from quarterly to semi-annual reporting from 2020, as this better suits the long-term nature of our businesses. We are pleased to confirm the date of our Capital Markets Day on 24 June 2020, at which we will provide an update on the strategic and financial developments of NN Group.’

(download the full Press Release)

Business update

Customers

NN’s ambition is to offer our customers personal and relevant products and services. In July, NN Bank introduced a new risk-based pricing system for NN mortgages, under which mortgage rates charged to customers are automatically lowered during the fixed rate period if the loan is eligible for a lower risk premium as a result of repayments. In case of an increase of real estate value, customers can request for a decrease of interest rate, if applicable to their situation. Furthermore, Nationale-Nederlanden launched a simplified term life insurance product, available via www.nn.nl. The offering is aimed at customers who wish to take out a policy to provide financial protection for their relatives, without seeking (financial) advice. This product is available alongside the existing, more extensive term life insurance, offered through insurance and mortgage brokers. BeFrank now offers customers the option of a sustainable pension scheme, whereby companies can choose to make their invested pension capital completely CO2-neutral through a tree planting scheme. The online pension provider works closely with Land Life Company, a company that plants trees on exhausted land.

NN in Slovakia launched an awareness PR initiative that prompts single parents to prepare financially for unexpected events. To support these customers, ‘NN Smart’ offers extensive healthcare coverage for parents and their children. The premium also covers part of the loss of income in situations such as long-term sickness and hospitalisation.

Partnerships

Supporting the responsible investing needs of our clients, NN Investment Partners (NN IP) partnered with Irish Life Investment Managers in September to expand its Enhanced Index Sustainable Equity range with three new funds with a more sustainable profile.

Sustainability

NN IP was again awarded the top score (A+) for its excellent strategy and governance approach to responsible investing and environmental, social and governance (ESG) integration by the UN Principles for Responsible Investment (UN PRI). In August, NN IP announced that it integrates the three ESG factors demonstrably and consistently throughout the investment process for two-thirds of its strategies. Early September, NN IP launched an ESG index fund investing in Polish blue-chip stocks included in the WIG-ESG index (index comprising WIG20 and WIG40 stocks (blue chips) listed on the Warsaw Stock Exchange. NN Group also contributed to the practical guide for insurers on managing climate-related risks and opportunities that was published in September by Shareaction/AODP (Asset Owners Disclosure Project).

Brand, sponsorships, events and awards

On 12 October 2019, NN Running Team athlete Eliud Kipchoge became the first person to finish a marathon in under two hours at the INEOS 1:59 Challenge. Nationale-Nederlanden Spain launched a partnership with Runnea, a leading running community. The collaboration provides customised training systems for runners via a dedicated website.

For the third consecutive year, NN IP won the Cashcow award in the Netherlands for being the best provider in Impact Investing. NN Bank was also awarded by Cashcow for being the best online asset manager. And, in September, NN IP was included in the annual incentive scheme by the Financial Services Commission for its contribution to Taiwan’s local fund industry. This allows NN IP to benefit from the introduction of new types of funds into Taiwan and to increase the ratio of Taiwanese investors for each fund.

Management changes

On 26 September 2019, the Supervisory Board of NN Group N.V. notified the Extraordinary General Meeting about the intended appointment of David Knibbe as member of the Executive Board and CEO of NN Group. The Supervisory Board subsequently appointed David Knibbe as from 1 October 2019 for a term of four years. It was also announced that Tjeerd Bosklopper will succeed him as CEO Netherlands on an ad interim basis. This appointment is subject to regulatory approval.

On 6 November 2019, it was announced that Jan-Hendrik Erasmus decided to step down as member of the Management Board and CRO of NN Group as of 31 December 2019. Delfin Rueda, CFO, will assume the responsibilities of the CRO portfolio until a suitable successor is found.

(download the full Press Release)

Analyst and investor call

David Knibbe (CEO) and Delfin Rueda (CFO) will host an analyst and investor conference call to discuss the 3Q19 results at 10:30 am CET on Thursday 14 November 2019. Members of the investment community can join the conference call at +31 20 531 5865 (NL), +44 203 365 3210 (UK), +1 866 349 6093 (US) or follow the webcast on www.nn-group.com/investors.

Press call

David Knibbe (CEO) and Delfin Rueda (CFO) will host a press call to discuss the 3Q19 results at 07:45 am CET on Thursday 14 November 2019. Journalists can join the press call at +31 20 531 5863 (NL).

Financial calendar

- Publication 4Q19 results: 13 February 2020

- AGM: 28 May 2020

- Capital Markets Day: 24 June 2020

- Publication 1H20 results: 6 August 2020

Additional information

- NN Group 3Q19 Financial Supplement, NN Group 3Q19 Analyst Presentation

- NN Group 30 September 2019 Condensed consolidated interim accounts

- Photos of NN Group executives, buildings and events are available for download at Flickr

-

NN Group is an international financial services company, active in 20 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, investments and banking to approximately 17 million customers. NN Group includes Nationale - Nederlanden, NN, NN Investment Partners, ABN AMRO Insurance, Movir, AZL, BeFrank and OHRA. NN Group is listed on Euronext Amsterdam (NN).

-

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation). NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. Condensed consolidated interim accounts for the period ended 30 September 2019.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (4) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (5) the frequency and severity of insured loss events, (6) changes affecting mortality and morbidity levels and trends, (7) changes affecting persistency levels, (8) changes affecting interest rate levels, (9) changes affecting currency exchange rates, (10) changes in investor, customer and policyholder behaviour, (11) changes in general competitive factors, (12) changes in laws and regulations and the interpretation and application thereof, (13) changes in the policies and actions of governments and/or regulatory authorities, (14) conclusions with regard to accounting assumptions and methodologies, (15) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (16) changes in credit and financial strength ratings, (17) NN Group’s ability to achieve projected operational synergies, (18) catastrophes and terrorist-related events, (19) adverse developments in legal and other proceedings and (20) the other risks and uncertainties contained in recent public disclosures made by NN Group.

Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and, NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.