NN Group reports full-year 2020 operating result of EUR 1.9 billion

Strong financial and commercial performance; cost reduction target achieved

Strong financial and commercial performance; cost reduction target achieved

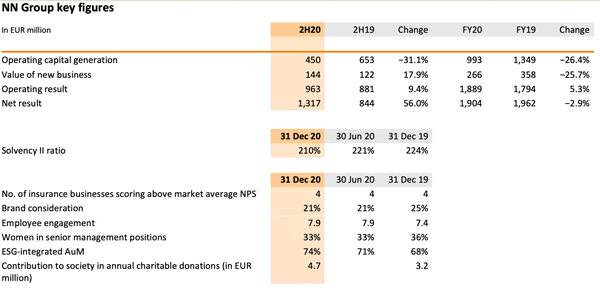

Operating result increased to EUR 963 million from EUR 881 million in the second half of 2019, mainly driven by a higher investment margin and lower administrative expenses at Netherlands Life; Full-year 2020 operating result of EUR 1,889 million, up 5.3% on 2019

Operating capital generation of EUR 450 million versus EUR 653 million in the second half of 2019, reflecting the negative impact of lower interest rates; Full-year 2020 operating capital generation of EUR 993 million, compared with EUR 1,349 million in 2019

Limited negative impact of Covid-19 on operating result of around EUR 23 million in the second half of 2020, bringing the full-year 2020 impact to EUR 53 million

Net result of EUR 1,317 million, up from EUR 844 million in the second half of 2019; Full-year 2020 net result of EUR 1,904 million versus EUR 1,962 million in 2019

Further cost reductions of EUR 23 million in the second half of 2020; total cost reductions of EUR 404 million versus the full-year 2016 administrative expense base, thereby achieving the cost reduction target

Value of new business of EUR 144 million, up 17.9% from the second half of 2019, mainly driven by the recovery in sales of COLI products in Japan Life

Focus on all stakeholders; high employee engagement and increased ESG-integrated Assets under Management

Customer satisfaction remained broadly stable amidst the pandemic, with 4 of our businesses scoring an above market average Net Promotor Score

Employee engagement increased substantially with an overall score of 7.9, up from 7.4 in 2019

ESG-integrated Assets under Management increased to 74% from 68% in 2019

Resilient balance sheet; delivering on our commitment to attractive capital returns to shareholders

NN Group Solvency II ratio of 210% versus 221% at 30 June 2020, mainly reflecting the inclusion of NN Bank in the Group Solvency II calculations as of the end of 2020 and the deduction of the proposed 2020 final dividend, partly offset by operating capital generation

Cash capital position at the holding decreased to EUR 1,170 million in the second half of 2020, reflecting capital flows to shareholders and remittances from subsidiaries

2020 final dividend proposal of EUR 1.47 per ordinary share or approximately EUR 456 million, bringing the pro forma total 2020 dividend to EUR 2.33 per ordinary share, up 7.9% on 20191)

New share buyback programme of EUR 250 million announced in line with dividend policy

Statement of David Knibbe, CEO

‘In 2020 we delivered a strong financial and commercial performance, even though it clearly was an unprecedented year, marked by the Covid-19 pandemic and various other economic, political and regulatory developments. These circumstances impacted people and societies, and are reshaping markets, industries and companies - which requires adaptability and resilience from us all. When designing our new strategy in the first half of the year, we took these changes into account as much as possible. It is our aim to pursue long-term value creation, based on the belief that a focus on the well-being of customers and employees is in the end beneficial for all our stakeholder groups.

For our employees, we want to create an inclusive and inspiring working environment, which stimulates agility, efficiency and transformation. Last year, our people demonstrated proactivity and flexibility in giving unwavering attention to our customers in a difficult change environment. This has also proven to be a strong accelerator for the transformation journey we embarked on, of becoming more customer centric and data driven. Thanks to the efforts of our colleagues, who were mostly working remotely, we were able to continue to go the extra mile for our customers. We were for example able to provide payment holidays for insurance premiums and mortgages to customers facing financial difficulties, and temporary coverage of delivery services for businesses that normally do not deliver products. Also, we supported the communities in which we live and work, for example by computer donations, enabling children to home school. Besides supporting customers to navigate today's challenges, we also want to help by giving them the confidence to look and plan ahead. This way, insurers can make an important contribution to economic recovery, a goal we are very committed to support.

Our overall financial performance remained strong in 2020. The second half-year operating result was up more than 9% compared with the same period in 2019, with Netherlands Life posting solid results on the back of the accelerated shift to higher-yielding assets in the first half of the year. At Netherlands Non-life, lower underwriting results in Disability & Accident were partly offset by lower claims in Property & Casualty and the inclusion of the results of VIVAT Non‐life. The overall combined ratio held up well at 95.7%. Further expense savings were achieved across the company, allowing us to achieve the cost savings target of EUR 400 million.

We saw resilient commercial momentum in the second half of the year as sales were up at Japan Life and Insurance Europe, resulting in a higher value of new business, despite Covid-19 restrictions. Defined Contribution assets under management increased to EUR 24.6 billion, reflecting our market leading position in Dutch pensions. Total Assets under Management at NN Investment Partners increased to EUR 300 billion, driven by positive market performance and strong net third party inflows of EUR 10.1 billion. NN Bank, the fifth largest mortgage originator in the Netherlands, originated new mortgages for a total amount of EUR 3.8 billion.

As expected, operating capital generation in 2020 was impacted by the exceptional market circumstances and low interest rates, as well as the suspension of bank dividends. On the other hand, our accelerated shift to higher-yielding assets provided some offset in the form of higher investment margins. Our strong solvency and capital generation support attractive and growing cash returns to shareholders. We followed the request for prudence from regulators, and limited dividend flows from our subsidiaries to the holding. However, our strong Solvency II ratio and capital generation allows us to fulfill the commitments made in our dividend policy.

With the aim to contribute to the well-being of people and planet, we supported the transition to a sustainable economy by engaging with hundreds of investee companies, and voting for change at more than 2,500 AGMs. Through these actions, we also give substance to our ambition to transition our proprietary investment portfolio to net-zero carbon emissions by 2050, in line with the Paris Agreement. Together with around 40 financial institutions, NN Investment Partners signed the Finance for Biodiversity Pledge calling on global leaders to act, and committing ourselves to protect and restore biodiversity through our finance activities and investments. We are pleased to have received external recognition for our ESG performance by again being included in the Dow Jones Sustainability Indices, both the World and Europe index, and by our improved CDP climate change disclosure A- rating.

All in all, we have made a promising start with the implementation of our new strategy and have a solid foundation for delivering both on our financial and non-financial target.’

(download the full Press Release)

Business update

At NN, we help people care for what matters most to them. Our purpose reflects the kind of company we aspire to be: a company that delivers long-term value for all stakeholders. Our ambition is to be an industry leader, known for our customer engagement, talented people, and contribution to society. To realise our ambition, we identified five strategic commitments, with all parts of our business contributing.

Customers and distribution

As part of our efforts to enhance customer engagement and focus on service solutions, we aim to be an active participant in platforms on key themes such as Selfcare and Carefree Retirement. In the Netherlands, we launched several initiatives such as Zorggenoot, a network of local experts who can help find, arrange and finance informal elderly homecare. We initiated Kwiek, a platform supporting people over 65 years find a job and fight loneliness, and we invested in Klup, a social platform for people over 50 years old.

Our distribution partners play a vital role in engaging with our customers. Our tied agents throughout Europe adjusted swiftly to remote sales and service processes and adapted to our customers’ changing needs. They made a major contribution to Insurance International results, increasing sales by 2% compared with 2019, despite challenges from Covid-19. In the Netherlands Life business, we managed to further grow the overall satisfaction of our business partners to 7.6. In the Netherlands Non-life and Bank business we steadily improved our broker and customer satisfaction over the year.

We continued to strengthen and expand our partnerships. In the Netherlands, we partnered with Insify, a digital insurance platform that enables small businesses to arrange their own insurance anytime, anywhere. Nationale-Nederlanden acquired a stake in Invers, a company developing smart technology to analyse and deliver financial data. In the Czech Republic, we entered a partnership with AirBank to sell and service our pension products. NN Belgium Life partnered with one of the most prominent brokers in Belgium, Wilink, strengthening our distribution in the retail and self-employed broker segments.

NN started the integration of Keerpunt in its label, HCS. Keerpunt is a quality player in the occupational health and safety service market. Its expertise and products, combined with HCS’s IT and innovation power, will enable us to further develop services for our customers.

Products and services

We launched several protection and living benefit products meeting our customers’ evolving needs. NN Romania entered the general insurance market by launching a home insurance product, and in just two months issued over 1,700 policies, of which 30% to new customers. In Spain, we introduced a flexible, transparent and guaranteed protection product targeted to the self-employed which allows them to pay only for the coverage they need. Sales of COLI products in Japan showed signs of recovery in the second half of 2020, supported by the launch of two new products at the beginning of the year, the Emergency Plus CSV and Emergency Plus LCV which offer sudden-death insurance to small and medium-sized enterprise (SME) owners.

In the Netherlands, we collaborated with Hyfen, APG, PGGM and Blue Sky Group to develop our first blockchain solution, an automated and digitised value transfer process for individual pensions, which also offers support with customer questions and reduces processing time. We also entered a collaboration with the Dutch Consumers’ Association (Consumentenbond) which will offer NN’s cybersecurity emergency call service, Cyberwacht, to their customers for one year.

NN Bank developed NOVA app, a digital household budget providing insights on customers’ actual spending. NN Bank also introduced Woonnu, a new mortgage label which incentivises sustainable living, for example by linking the mortgage interest rate to the home’s energy label.

NN IP expanded its mortgage proposition with two new funds. Partnering with Channel Capital Advisors LLP, NN IP also initiated the NN (L) Flex Trade Finance fund, offering institutional investors access to a conservative portfolio of globally sourced, short-dated trade finance loans. In addition, NN IP strengthened its global Emerging Markets Debt (EMD) team by transferring MN’s EMD team including USD 4 billion of MN’s in-house managed EMD assets to NN IP. The total size of NN IP’s AuM in EMD is now over USD 17 billion.

People and organisation

We are on a journey to transform our company, which also means enabling colleagues to adapt to change. The Covid-19 pandemic measures in 2020 required great flexibility from employees, while at the same time led to enhanced digitisation and new ways of working. Our colleagues embraced these ongoing changes throughout the year, as evidenced by the high engagement score of 7.9 based on the semi-annual survey carried out in the second half of 2020.

We want to be known for our talented employees, and we do this by fostering the NN culture and creating an inclusive working environment. In December, we launched NN’s diversity and inclusion (D&I) statement, explaining our approach to creating a more inclusive workforce, customer experience and community support. We also started the internal series Wo{men}talk to discuss D&I-related topics, and we initiated the NN Pride Network to connect colleagues within the LGBTI+ community.

The integration of VIVAT Non-life is progressing well, and a total of 380 new colleagues from VIVAT joined NN and received a warm virtual welcome.

Financial strength

We aim to maintain a strong balance sheet and generate attractive financial returns for shareholders.

On 17 December 2020, European regulator EIOPA published an Opinion to the European Commission on the review of Solvency II. A change of legislation is expected to be implemented at the earliest in 2024. Based on the EIOPA Opinion and the prevailing market conditions in December, the net impact from the proposed changes to NN Group’s Solvency II ratio at the anticipated implementation date is expected to be manageable.

In September, NN Bank issued a EUR 500 million 15-year Soft Bullet Covered bond at an attractive yield, thereby further broadening its investor base and lengthening its funding profile.

Society

NN IP has again been awarded the top score (A+) from the UN Principles for Responsible Investment (UN PRI), for its strategy and governance approach to responsible investing and its ESG integration. NN IP also ranked sixth amongst the world’s largest asset managers using proxy voting for action on climate and social issues, by ShareAction, an association dedicated to raising awareness and participation of sustainable practices in financial activities.

Once more NN was the top-scoring company in the annual Tax Transparency Benchmark, published by the Dutch association of investors for Sustainable Development (VBDO). The jury praised NN for further improving the disclosures of direct and other taxes on a country-by-country basis, and for gaining third-party tax assurance on its 2019 Total Tax Contribution Report.

We continue to focus on supporting our communities during Covid-19 through various initiatives. For example, in the Czech Republic, 150 employees took part in a challenge to support single parent families, lonely seniors and people in senior care homes. In the Netherlands, 350 colleagues were trained as home administration volunteers, a training developed by the National Institute for Family Finance Information (Nibud), and are now able to help family members and friends when they face challenging financial circumstances. We also made donations to the association of Dutch food banks and other charitable organisations.

(download the full Press Release)

Analyst and investor call

David Knibbe (CEO) and Delfin Rueda (CFO) will host an analyst and investor conference call to discuss the 2H20 results at 10:00 am CET on Thursday 18 February 2021. Members of the investment community can join the conference call at +31 20 531 5865 (NL), +44 203 365 3210 (UK), +1 866 349 6093 (US) or follow the webcast on www.nn-group.com.

Press call

David Knibbe (CEO), Delfin Rueda (CFO) and Bernhard Kaufmann (CRO) will host a press call to discuss the 2H20 results at 07:45 am CET on Thursday 18 February 2021. Journalists can join the press call at +31 20 531 5863 (NL).

Financial calendar

- AGM: 20 May 2021

- Publication 1H21 results: 12 August 2021

Additional information

NN Group 2H20 Financial Supplement, NN Group 2H20 Analyst presentation, NN Group Company profile and NN Group ESG presentation

- Photos of NN Group executives, buildings and events are available for download at Flickr

- NN Group profile

NN Group is an international financial services company, active in 20 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, investments and banking to approximately 18 million customers. NN Group includes Nationale-Nederlanden, NN, NN Investment Partners, ABN AMRO Insurance, Movir, AZL, BeFrank and OHRA. NN Group is listed on Euronext Amsterdam (NN).

- Important legal information

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation). NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. condensed consolidated interim accounts for the period ended 30 June 2020. The Annual Accounts for 2020 are in progress and may be subject to adjustments from subsequent events. All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) the effects of the Covid-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which NN Group operates, on NN Group’s business and operations and on NN Group’s employees, customers and counterparties (3) changes in performance of financial markets, including developing markets, (4) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (5) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (6) the frequency and severity of insured loss events, (7) changes affecting mortality and morbidity levels and trends, (8) changes affecting persistency levels, (9) changes affecting interest rate levels, (10) changes affecting currency exchange rates, (11) changes in investor, customer and policyholder behaviour, (12) changes in general competitive factors, (13) changes in laws and regulations and the interpretation and application thereof, (14) changes in the policies and actions of governments and/or regulatory authorities, (15) conclusions with regard to accounting assumptions and methodologies, (16) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (17) changes in credit and financial strength ratings, (18) NN Group’s ability to achieve projected operational synergies, (19) catastrophes and terrorist-related events, (20) adverse developments in legal and other proceedings and (21) the other risks and uncertainties contained in recent public disclosures made by NN Group. Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason. This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.