NN Group reports strong commercial and financial performance for second-half and full-year 2021

Delivering on our financial targets

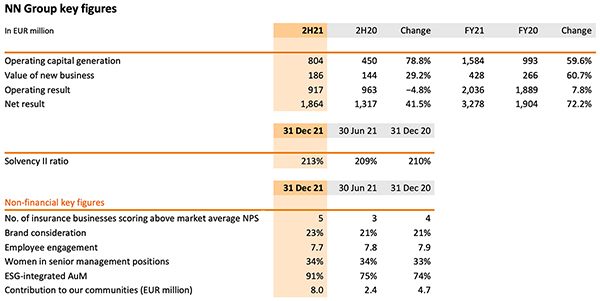

Operating capital generation increased to EUR 804 million from EUR 450 million in the second half of 2020, driven by strong business performance and commercial momentum; Full-year 2021 operating capital generation of EUR 1,584 million versus EUR 993 million in 2020

Operating result of EUR 917 million versus EUR 963 million in the second half of 2020; Full-year 2021 operating result of EUR 2,036 million, up 7.8% on 2020

Net result of EUR 1,864 million, up from EUR 1,317 million in the second half of 2020; Full-year 2021 net result of EUR 3,278 million versus EUR 1,904 in 2020

Strong commercial momentum; interim targets defined for our net-zero emissions ambition

Value of new business of EUR 186 million, up 29.2% from the second half of 2020, reflecting higher sales and an improved margin at Japan Life as well as higher sales at Insurance Europe

NN Bank and Woonnu originated record volume of new mortgages of EUR 9.9 billion in 2021

Netherlands Life’s DC Assets under Management increased to EUR 29.9 billion from EUR 27.4 billion at 30 June 2021, driven by market growth and net inflows

Improved customer satisfaction with 5 of our businesses scoring an above market average Net Promoter Score

ESG-integrated Assets under Management increased to 91%; interim targets defined to underpin our net-zero emissions ambition for both our investments as well as our business operations

Robust balance sheet and attractive capital returns to shareholders

NN Group Solvency II ratio of 213% versus 209% at 30 June 2021, mainly reflecting operating capital generation and favourable market impacts, partly offset by the deduction of the proposed 2021 final dividend

Cash capital position at the holding increased to EUR 1,998 million from EUR 1,533 million at 30 June 2021, reflecting free cash flow to the holding and proceeds from the issuance of senior debt, partly offset by capital flows to shareholders and amounts paid for acquisitions

2021 final dividend proposal of EUR 1.56 per ordinary share or approximately EUR 476 million, bringing the total 2021 dividend to EUR 2.49 per ordinary share, up 7% on 2020

New share buyback programmes for a total amount of EUR 1.0 billion

Statement of David Knibbe, CEO

‘In the second half of 2021, we saw a continued strong commercial and financial performance. We remained focused on engaging with our customers to meet their needs and to offer solutions that create long-term value, especially in these uncertain times. The Covid-19 pandemic entered its second year and continued to dominate our daily lives. It is putting pressure on sickness and disability rates, which makes our efforts to support and reintegrate customers even more significant. The global economy rebounded strongly from a severe contraction in 2020, but financial markets were turbulent and inflation has risen in many parts of the world. Extreme weather struck during the summer of 2021, underscoring the real-life impact of climate change. These developments contributed to a higher awareness of risk and vulnerability, which resulted in an increased demand for protection products. This supported the substantial increase in NN Group’s value of new business of 61% over the year. All of our business segments performed better compared with a year earlier, with strong results at Netherlands Non-life, despite the claims resulting from the floods in July, as well as higher sales in Japan.

To support our growth ambition, we assess and optimise our portfolio of businesses. In 2021, this led to a number of acquisitions and divestments. We reached an agreement to acquire MetLife’s business activities in Greece and Poland, which will further strengthen our leading positions in these growth markets. The acquisition of MetLife Greece was completed on 31 January 2022 and we expect Poland to follow in the first half of this year. In addition, we acquired a 70% stake in Heinenoord in the Netherlands, in order to strengthen our distribution capabilities and reinforce our position in the Dutch non-life market. Furthermore, we divested our Bulgaria business and took the decision to sell the closed book life portfolio of NN Belgium. We also reached an agreement on the sale of our asset manager, NN Investment Partners, to Goldman Sachs Group, which is expected to be completed in the coming months. The partnership with Goldman Sachs Asset Management will provide us the optionality to develop a broader range of asset management propositions to our customers.

Contributing to the well-being of people and the planet is one of our key strategic commitments. We aim to support the transition to a low-carbon economy across our business activities and operations, and want to offer products and services that reflect the different needs of the societies in which we operate. For example, we assist our customers in making their houses more energy efficient; the bank’s sustainable mortgage label, Woonnu, continued to be in demand and originated EUR 1.4 billion of mortgages in 2021. In November, we also set interim targets to align with the Paris Agreement on the reduction of greenhouse gas emissions. By 2025 we aim to reduce the emissions of our corporate investments by 25% and of our own operations by 35%, compared with 2019. As part of this, for new investments we focus on companies which we view as frontrunners in the transition to a low-carbon economy, and aim to more than double our investments in climate solutions by 2030. Additionally, today we launched a sustainability bond framework, to enable the future issue of green, social and sustainability bonds.

Thanks to the efforts of our colleagues, who have mostly been working from home since the start of the pandemic, we have been able to further improve our customer satisfaction scores. Using remote working and digital channels we continued serving our customers and other stakeholders, under different and at times challenging circumstances. Therefore, we are pleased to see that the high employee engagement scores remained broadly stable in 2021. All in all, we are well on track to achieve our financial and non-financial targets in 2023.

Operating capital generation in the second half of 2021 was EUR 804 million driven by the strong business performance and commercial momentum. This brings total capital generation for 2021 to almost EUR 1.6 billion, already meeting our EUR 1.5 billion target that we set for 2023. Even after the sale of the asset management unit in the coming months, our 2023 target for operating capital generation remains unchanged given the expected contribution in the coming years from the acquired businesses, as well as ongoing strong performance across the group.

The significant growth in capital generation supports the robust balance sheet and capital position of NN Group. The Solvency II ratio was 213% and holding company cash capital was EUR 2.0 billion at year-end 2021. In the coming months, we expect to receive the proceeds from the sale of our asset manager, while also paying the consideration for the acquisition of the MetLife businesses as well as redeeming the maturing senior debt. This allows us to deliver substantial capital returns to our shareholders. We have announced today a proposed final dividend of EUR 1.56 per share and share buyback programmes for a total amount of EUR 1.0 billion.’

(download the full Press Release)

Delivering on our strategic commitments

At NN, we help people care for what matters most to them. Our purpose reflects the kind of company we aspire to be: a company that delivers long-term value for all stakeholders. Our ambition is to be an industry leader, known for our customer engagement, talented people, and contribution to society. To realise our ambition, we identified five strategic commitments, with all parts of our business contributing.

Customers and distribution – enhanced customer engagement

In the second half of 2021, we continued our efforts to enhance customer engagement, by developing platforms on key themes such as Carefree Retirement and Selfcare. In the Netherlands we launched WYZ, a digital one-stop shop for people over 50, providing useful content and access to services such as informal homecare (Zorggenoot) and employment (Kwiek).

In addition to developing our own customer engagement platforms, we reach customers through embedding our products in existing ones. For example, our e-bike insurance product is currently sold in four European countries via 32 partners, including e-bike dealers, manufacturers and brokers. By integrating our product into distributors’ platforms, we offer customers protection against theft, damage and roadside breakdown for their new bicycle at a convenient moment in the purchasing process. This also helps expand our non-life insurance offering and access customers in new markets.

With the aim to simplify the insurance application process, NN Life Japan partnered with DataRobot, a machine-learning solution provider, to implement automated technology in incremental steps within 2022. With the help of artificial intelligence, the application process could be as short as three minutes from the current ‘two-to-three day’ cycle.

Our increased focus on customer engagement is reflected in improved customer and broker satisfaction scores in 2021. At the end of the year, five of our insurance business units scored above market average on NPS and three insurance business units scored on par with market average. We have launched several initiatives to gain more insights on NPS such as best practice sharing sessions and additional driver studies that give each business unit details on their relative performance, improvement areas and directions.

Products and services – Meeting customers’ needs with new, protection and sustainable products

We continued our efforts to meeting our customers’ evolving needs, with new and improved protection products. For example, in Hungary, we launched a new income protection insurance as an add-on to our main life insurance products and offering a monthly allowance for customers experiencing financial difficulties due to incapacity or unemployment. In Hungary, we also offer a health assistance service to all our individual customers. The health assistance includes a 24/7 call centre and an online platform where customers can either book an appointment to meet a doctor in person or consult with a physician online.

As market leader in pension savings, NN Slovakia introduced an ESG pension fund and became the first company in Slovakia to do so. The Respect Fund is unique, as it invests the savings based on environmental, social, and corporate governance criteria. In addition, NN Belgium received two awards for the best Belgian sustainable fund offering and for the best Belgian term life product.

BeFrank celebrated its ten-year anniversary having grown into the largest Premium Pension Institution (PPI) in the Netherlands, with more than 1,000 clients and 270,000 pension participants and with total Assets under Management of around EUR 6.8 billion. BeFrank is the only brand in the Dutch market that offers a CO2 neutral pension scheme to customers.

NN IP made progress on its strategic ambition to build a globally recognised alternative credit capability. Its efforts were also externally recognised with an improved ranking and still the only Dutch-based asset manager in the Global Top 100 Private Debt Fund Raisers. Notwithstanding the current divestment process, NN IP attracted new mandates, with net third-party inflows of EUR 5.2 billion in 2021.

People and Organisation – Progress in becoming a more diverse and inclusive workplace

We nurture a culture aimed at empowering our colleagues to be their best. The changing Covid-19 situation, requires us to continuously adjust our working conditions. During the second half of the year, we intensified our preparations to combine working from home with working in the office, offering a mix of tools to our colleagues. Our semi-annual employee engagement survey carried out in the second half of 2021 revealed that NN colleagues’ engagement remained high at 7.7 (compared with 7.8 in June 2021). The survey results show that colleagues feel empowered to fulfil their role, despite the circumstances, and have room for professional growth, but a point for attention is process efficiency.

During the second half of 2021, we strengthened our efforts towards becoming a more diverse and inclusive (D&I) workplace. We conducted a series of workshops in our markets, involving internal and external stakeholders. This led to a maturity gap analysis report with a thorough analysis and action plan for each market aimed at improving our position on diversity. We launched a D&I ambassadors network with country representatives who discuss, challenge and inspire each other on D&I-related topics. In Belgium, Japan and Spain we extended paternity leave. NN Spain was recognised as one of the 30 companies with the best D&I practices in the country.

Financial strength – Maintaining a strong balance sheet and generating attractive returns

The integration of VIVAT Non-life has reached a final stage with the completion of the migration of 1.8 million policies to NN systems. We have already achieved our EUR 40 million cost savings target, a year earlier than planned, and are working towards finalising the integration in the first half of this year.

NN Group reached an agreement with ABN AMRO Bank and our joint venture ABN AMRO Verzekeringen (AAV) to sell AAV’s life insurance subsidiary to NN Life & Pensions. AAV’s life insurance activities will be integrated into NN Life & Pensions and together with ABN AMRO Bank, we will make additional investments in the coming years to strengthen AAV’s digital capabilities and further grow its non-life portfolio. The transaction is subject to regulatory approvals and is expected to close in the second half of 2022.

In December 2021, NN Re entered into the market of reinsurance through catastrophe bonds, used as a form of external risk transfer in the event of a natural disaster, for an amount of EUR 75 million and a duration of three years.

At the end of December 2021, NN Life completed a longevity reinsurance transaction to transfer the full longevity risk associated with approximately EUR 4 billion of pension liabilities. This will reduce NN’s exposure to longevity risk, and consequently reduce the required capital and further strengthen NN’s capital position. The longevity reinsurance agreement has no impact on the services and guarantees that NN provides to its policyholders. The transaction is expected to have limited financial impact on NN Group.

Following the publication of its Green Bond Framework in June 2021, NN Bank issued a seven-year EUR 500 million inaugural green bond under the Framework in September 2021. The bond qualifies as Minimum Required Eligible Liabilities (MREL) and was distributed to a large group of institutional investors. The proceeds of the bond are used to (re)finance mortgages for energy efficient residential properties in the Netherlands and supports NN Bank's objective to make its mortgage portfolio more sustainable.

Society – Raising financial awareness and investing to support our communities

NN has joined forces with the Amsterdam School of Economics at the University of Amsterdam to open the Research Centre for Longevity Risk, a new, independent research centre to conduct research on the financial and social consequences of changing life expectancies.

The percentage of NN IP’s assets under management (AuM) where environmental, social and governance (ESG) factors are integrated in the investment process increased to 91%, driven by the inclusion of mortgage portfolios and the qualification of other Alternative Credit portfolios as ESG-integrated.

As a member of the Net Zero Asset Managers Initiative, NN IP is committed to support the goal of net zero greenhouse gas emissions by 2050. As part of this commitment, NN IP announced in November its initial scope of assets to be managed in line with reaching net-zero in 2050 or sooner. The scope includes assets managed in equity, corporate fixed income and sovereign bond portfolios. To underpin NN Group’s ambition to accelerate the transition to a low-carbon economy, we have set interim targets for 2025 and 2030 for the reduction of greenhouse gas emissions of our corporate investment portfolio. In October, NN Group became a member of the Net-Zero Insurance Alliance.

Nationale-Nederlanden, which has a leading position in the Dutch group pensions market, continued its efforts to raise awareness on the new Pension Agreement. ‘Pensioen TV’ broadcasts launched earlier in the year proved to meet a real need. In addition, and on the occasion of Sustainable September, we extended our efforts beyond raising awareness to informing Dutch citizens on the sustainability of NN’s pension schemes by publishing articles, interviews and videos and an online magazine on sustainability.

For the third consecutive year, NN has been the leading company in the annual Tax Transparency Benchmark, published by the Dutch association of investors for Sustainable Development (VBDO). The benchmark ranks 77 Dutch listed companies on the level of transparency they provide on tax and the quality of tax governance they demonstrate.

Throughout the year we continued supporting our communities through various initiatives and partnerships. For example, experts from NN Poland shared their knowledge with user experience design and supported the development of virtual reality glasses for children with cancer. During medical procedures, young patients use VR glasses, helping reduce their stress during treatments. NN Romania entered into a partnership with Children’s Heart Association (Asociatia Inima Copiilor). We invested in the expansion the Cardio Surgery Department of Marie Curie Hospital in Bucharest and developed a platform inviting citizens to donate via SMS, doubling the donations until the necessary amount for the medical unit’s expansion is reached. NN Group’s total contributions to its communities increased to EUR 8.0 million in 2021, including more than 13,500 hours of volunteering and more than EUR 6.2 million in cash donations.

(download the full Press Release)

Press call

David Knibbe (CEO), Delfin Rueda (CFO) and Bernhard Kaufmann (CRO) will host a press call to discuss the 2H21 results at 07:45 am CET on Thursday 17 February 2022. Journalists can join the press call at +31 20 531 5863 (NL).

Analyst and investor call

David Knibbe (CEO), Delfin Rueda (CFO) and Bernhard Kaufmann (CRO) will host an analyst and investor conference call to discuss the 2H21 results at 10:00 am CET on Thursday 17 February 2022. Members of the investment community can follow the live audio webcast on NN Group - Investors (nn-group.com).

Analysts can participate in the Q&A by registering according to the following instructions:

Register for the conference call online at link

After registration, you will receive a confirmation e-mail containing the dial-in number, entry code and personal ID code

Use these details to dial in to the conference call

Financial calendar

- AGM: 19 May 2022

- Publication 1H22 results: 11 August 2022

- Investor Update: 17 November 2022

Additional information on www.nn-group.com

NN Group 2H21 Financial Supplement, NN Group 2H21 Analyst Presentation, NN Group Company Profile and NN Group ESG presentation

- Photos of NN Group executives, buildings and events are available for download at Flickr

-

NN Group is an international financial services company, active in 19 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, investments and banking to approximately 18 million customers. NN Group includes Nationale-Nederlanden, NN, NN Investment Partners, ABN AMRO Insurance, Movir, AZL, BeFrank and OHRA. NN Group is listed on Euronext Amsterdam (NN).

-

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation).

NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. Condensed consolidated interim financial information for the period ended 30 June 2021. The Annual Accounts for 2021 are in progress and may be subject to adjustments from subsequent events.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) the effects of the Covid-19 pandemic and related response measures, including lockdowns and travel restrictions, on economic conditions in countries in which NN Group operates, on NN Group’s business and operations and on NN Group’s employees, customers and counterparties (3) changes in performance of financial markets, including developing markets, (4) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (5) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (6) the frequency and severity of insured loss events, (7) changes affecting mortality and morbidity levels and trends, (8) changes affecting persistency levels, (9) changes affecting interest rate levels, (10) changes affecting currency exchange rates, (11) changes in investor, customer and policyholder behaviour, (12) changes in general competitive factors, (13) changes in laws and regulations and the interpretation and application thereof, (14) changes in the policies and actions of governments and/or regulatory authorities, (15) conclusions with regard to accounting assumptions and methodologies, (16) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (17) changes in credit and financial strength ratings, (18) NN Group’s ability to achieve projected operational synergies, (19) catastrophes and terrorist-related events, (20) adverse developments in legal and other proceedings and (21) the other risks and uncertainties contained in recent public disclosures made by NN Group.

Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.