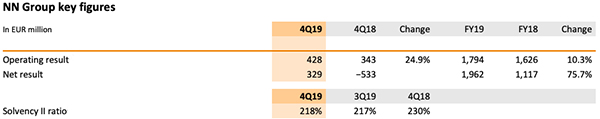

4Q19 operating result increased to EUR 428 million from EUR 343 million in 4Q18, reflecting improved results at almost all segments; Full-year 2019 operating result of EUR 1,794 million, up 10.3% from 2018

4Q19 net result of EUR 329 million versus EUR -533 million in 4Q18 which included a goodwill impairment; Full-year 2019 net result of EUR 1,962 million versus EUR 1,117 million in 2018

Further cost savings of EUR 36 million in 4Q19, bringing total cost reductions to EUR 360 million versus the full-year 2016 administrative expense base

Full-year 2019 value of new business of EUR 358 million, down 8.3% from 2018, reflecting lower sales in Japan due to a tax change, partly offset by an improved business mix and higher life and pension sales at Insurance Europe

Customer satisfaction improved in 2019; NN Group Net Promoter Score increased to +4 versus -1 in 2018

Solvency II ratio of 218% reflects operating capital generation and positive market impacts, partly offset by the deduction of the proposed 2019 final dividend

Holding company cash capital increased to EUR 1,989 million in the fourth quarter of 2019, reflecting net remittances received from subsidiaries, and cash outflow to repurchase own shares

2019 final dividend proposal of EUR 1.40 per ordinary share (EUR 448 million), bringing the full-year 2019 dividend to EUR 2.16 per ordinary share (EUR 698 million)

Share buyback programme of EUR 250 million to be completed within 12 months, anticipated to commence on 2 March 2020

Updated dividend policy consisting of a progressive dividend per share and a recurring annual share buyback of at least EUR 250 million

Statement of David Knibbe, CEO

‘NN Group’s financial performance was strong in the fourth quarter with the operating result 25% higher compared with the same quarter last year. The full-year 2019 operating result was up by 10% on 2018 with most segments contributing. The measures we are taking to improve the profitability of the Non-life business are bearing fruit, demonstrated by the full-year combined ratio of 95.4% compared with 99.4% in 2018. We have made additional efficiency gains by further reducing the cost base of the units in the scope of the integration by EUR 36 million in the fourth quarter, bringing total cost savings to date to EUR 360 million.

Customer satisfaction improved during the year, with the Group Net Promoter Score increasing 5 points from -1 in 2018 to +4. Motivated and engaged colleagues are key to providing an excellent customer service and this is reflected in a higher employee engagement score of 7.4 compared with 7.1 in 2018. New sales at Insurance Europe and Netherlands Life were up in 2019, while sales in Japan were impacted by the new tax rules for COLI (Corporate-Owned Life Insurance) products. Total value of new business in 2019 was down 8% on 2018, reflecting the lower sales in Japan, partly offset by 21% growth in Europe. NN Bank originated a record amount of EUR 8 billion in mortgages in 2019. The total Assets under Management at our asset manager increased by EUR 30 billion in 2019 to EUR 276 billion, driven by positive market performance.

During the year we continued to strengthen our distribution and customer platforms, including through new strategic partnerships. The acquisition of Human Capital Services (HCS) in the Netherlands reinforced our position with regard to sustainable employability, and supports the broader shift from insurance products to service solutions. The announced acquisition of VIVAT Non-life will further strengthen our market position in the Non-life segment in the Netherlands. Our balance sheet remains strong, with a Solvency II ratio of 218% after deducting the final dividend, and a cash capital position of close to EUR 2 billion at the end of 2019. We will propose a 2019 final dividend of EUR 1.40 per ordinary share at our annual general meeting of shareholders on 28 May 2020, which brings the full-year 2019 dividend per ordinary share to EUR 2.16, up almost 14% from 2018.

NN Group has a track record of distributing excess capital to shareholders. Our approach to this has not changed. We have today announced a new share buyback programme of EUR 250 million, anticipated to commence on 2 March 2020, which will be completed within 12 months. This decision takes into account the fact that we expect cash outflows in 2020 relating to the acquisition of Vivat Non-life and the repayment of maturing senior debt which we intend not to refinance.

Going forward we will pay a progressive ordinary dividend per share. We will also continue to return excess capital to shareholders, with a recurring annual share buyback of at least EUR 250 million under normal circumstances.

In April, we will celebrate the 175th anniversary of Nationale-Nederlanden and the founding of our predecessor ‘De Nederlanden van 1845’. During all these years, we have been dedicated to meeting and exceeding our customers’ expectations. Based on this foundation we are further sharpening our strategy, investing in growth and in the transformation of our businesses, with the aim to create long-term value for our customers and other stakeholders. We will present our new plans at the Capital Markets Day on 24 June.’

(download the full Press Release)

Business update

Our business is built on a solid foundation of purpose, values and brand attributes, which, combined with a strong focus on our strategic priorities, enables us to create long-term value. This is how we deliver on our ambition to be a company that truly matters in the lives of our stakeholders.

Customers

The International insurance business launched new products in several markets to increase its service offering to customers. Nationale-Nederlanden in Spain launched Contigo Futuro, a financial product and tool that helps customers reaching their personal savings goals. Environmental, social and corporate governance criteria are being applied to the investments made via the tool. In addition, Contigo Futuro includes a protection rider that waives premiums if the customer suffers permanent disability. NN in Turkey launched a health insurance that covers the surcharges for medical services from private medical institutions that are contracted by the state Social Security system. This product results from government efforts to relieve overcrowded public hospitals and is sold via agents and joint ventures. NN in Hungary announced plans to introduce payment protection insurance, home insurance and travel insurance products in 2020 and 2021. In addition, NN Slovakia launched NN Partner, a new risk life insurance product. The basic component is death coverage with a guaranteed sum, plus a traffic accident death benefit. Additional riders can cover death, disability, illnesses and accidents. NN Partner has been available via most brokers since 1 October 2019.

Dutch group Robeco’s pension scheme assigned its fiduciary mandate of EUR 750 million to NN Investment Partners (NN IP). In addition, NN IP was selected as the fiduciary manager for the EUR 3.2 billion portfolio of the Dutch pension fund for notaries and their staff.

NN wants to offer its customers personal and relevant products and services. To this end, Nationale-Nederlanden in the Netherlands introduced Smart Move, a personalised digital checklist for customers who are moving house detailing the actions needed before, during and after the move. Customers have the option to outsource multiple tasks and book them directly. Together with Tango, an operator of unmanned petrol stations, we started a pilot for car insurance allowing owners to just pay for kilometres driven while being insured at all times. Tango Car Insurance is modelled on the Nationale-Nederlanden’s Bundelz concept which was developed in our SparkLab innovation lab.

We also saw strong growth in our health insurance business, with more than 60,000 new customers welcomed by OHRA Zorg and NN Zorg for the new 2020 policy year.

Partnerships

In November, NN IP acquired a majority stake in Venn Hypotheken, allowing the asset manager to broaden its offering to its institutional clients to invest in Dutch mortgages, besides the existing NN Dutch Residential Mortgages Fund. In October, NN IP and Irish Life Investment Managers expanded their joint product range with three enhanced index funds, which offer investors a way to responsibly invest while closely tracking an established stock index, as well as with a Real Liability Driven Investment fund, which hedges pension liabilities against inflation and interest rate risks.

Brand, sponsorships, events and awards

In November, NN Group was awarded the top-scoring company in the fifth annual Tax Transparency Benchmark published by the Dutch Association of Investors for Sustainable Development. We believe our tax contributions play an important role for the communities in which we operate. BeFrank was awarded by PensioenWegwijzer 2019 for the most effective pension communication. In October, NN Czech was recognised as the best life insurance company in the Czech market by Hospodářské noviny, one of the leading Czech financial daily newspapers. NN Belgium was awarded the innovation and term life product prize at the Belgian Life Insurance awards ceremony organised by Decavi. The innovation award was received for NN Lifelong Income, our annuity solution that is unique in the market. The term life product prize was received for NN Hypo care, in the category Best Debt Balance Insurance/Term Life insurance linked to mortgages. Further, ABN AMRO Verzekeringen was awarded best insurer by Dutch Magazine Management Team (MT1000) for the third consecutive year.

(download the full Press Release)

Analyst and investor call

David Knibbe (CEO) and Delfin Rueda (CFO and interim CRO) will host an analyst and investor conference call to discuss the 4Q19 results at 10:30 am CET on Thursday 13 February 2020. Members of the investment community can join the conference call at +31 20 531 5865 (NL), +44 203 365 3210 (UK), +1 866 349 6093 (US) or follow the webcast on www.nn-group.com/investors.

Press call

David Knibbe (CEO) and Delfin Rueda (CFO and interim CRO) will host a press call to discuss the 4Q19 results at 07:45 am CET on Thursday 13 February 2020. Journalists can join the press call at +31 20 531 5863 (NL).

Financial calendar

- Annual General Meeting: 28 May 2020

- Capital Markets Day: 24 June 2020

- Publication 1H20 results: 6 August 2020

- Publication 2H20 results: 11 February 2021

Additional information

-

NN Group is an international financial services company, active in 20 countries, with a strong presence in a number of European countries and Japan. With all its employees, the Group provides retirement services, pensions, insurance, investments and banking to approximately 17 million customers. NN Group includes

Nationale-Nederlanden, NN, NN Investment Partners, ABN AMRO Insurance, Movir, AZL, BeFrank and OHRA. NN Group is listed on Euronext Amsterdam (NN). -

Elements of this press release contain or may contain information about NN Group N.V. within the meaning of Article 7(1) to (4) of EU Regulation No 596/ 2014 (Market Abuse Regulation). NN Group’s Consolidated Annual Accounts are prepared in accordance with International Financial Reporting Standards as adopted by the European Union (“IFRS-EU”) and with Part 9 of Book 2 of the Dutch Civil Code. In preparing the financial information in this document, the same accounting principles are applied as in the NN Group N.V. Condensed consolidated interim accounts for the period ended 30 September 2019. The Annual Accounts for 2019 are in progress and may be subject to adjustments from subsequent events.

All figures in this document are unaudited. Small differences are possible in the tables due to rounding. Certain of the statements contained herein are not historical facts, including, without limitation, certain statements made of future expectations and other forward-looking statements that are based on management’s current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Actual results, performance or events may differ materially from those in such statements due to, without limitation: (1) changes in general economic conditions, in particular economic conditions in NN Group’s core markets, (2) changes in performance of financial markets, including developing markets, (3) consequences of a potential (partial) break-up of the euro or European Union countries leaving the European Union, (4) changes in the availability of, and costs associated with, sources of liquidity as well as conditions in the credit markets generally, (5) the frequency and severity of insured loss events, (6) changes affecting mortality and morbidity levels and trends, (7) changes affecting persistency levels, (8) changes affecting interest rate levels, (9) changes affecting currency exchange rates, (10) changes in investor, customer and policyholder behaviour, (11) changes in general competitive factors, (12) changes in laws and regulations and the interpretation and application thereof, (13) changes in the policies and actions of governments and/or regulatory authorities, (14) conclusions with regard to accounting assumptions and methodologies, (15) changes in ownership that could affect the future availability to NN Group of net operating loss, net capital and built-in loss carry forwards, (16) changes in credit and financial strength ratings, (17) NN Group’s ability to achieve projected operational synergies, (18) catastrophes and terrorist-related events, (19) adverse developments in legal and other proceedings and (20) the other risks and uncertainties contained in recent public disclosures made by NN Group. Any forward-looking statements made by or on behalf of NN Group speak only as of the date they are made, and, NN Group assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.

This document does not constitute an offer to sell, or a solicitation of an offer to buy, any securities.