Our history

Our history goes back more than 180 years. Over the years our company has merged, grown and changed, but the core of who we are has remained the same; we help people care for what matters most to them.

Our roots

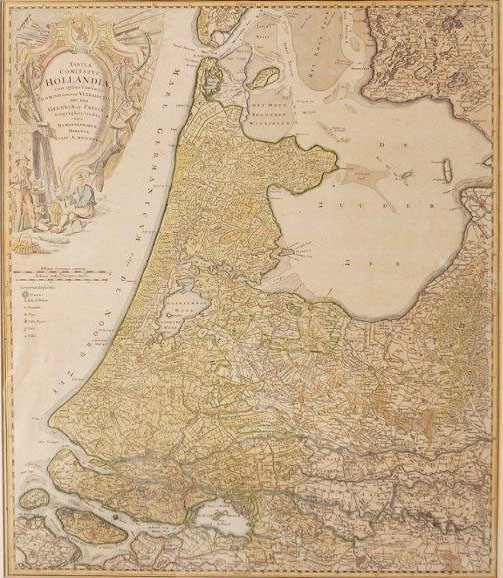

NN Group became an independent company in 2014, but we have a strong history that stretches back to the 18th century, when regional funds in the Netherlands started to provide insurance. Since then, we have built leading positions in our predominantly European markets, whilst also maintaining a strong presence in Japan.

1845-1880 'Early years'

At the beginning of the 19th century, the Netherlands had low prosperity with low economic growth. For the insurance market, this meant that it was largely dominated by mutual funeral funds. Economic activity slowly increased, which also boosted the demand for insurance. This is how the modern insurers, as we know them today, were founded.

1845

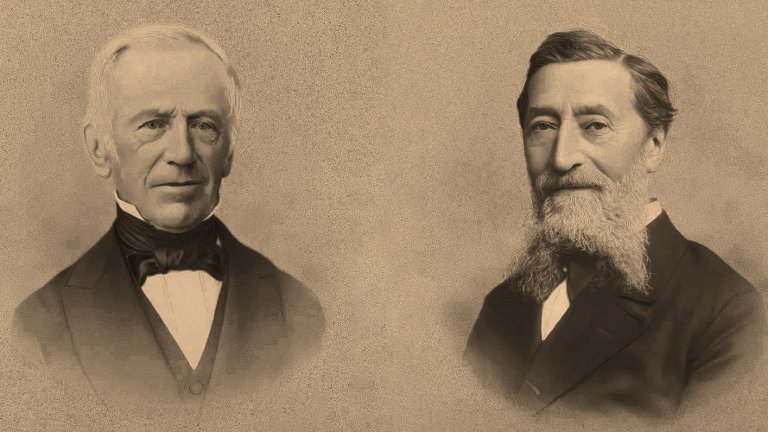

Our founding fathers

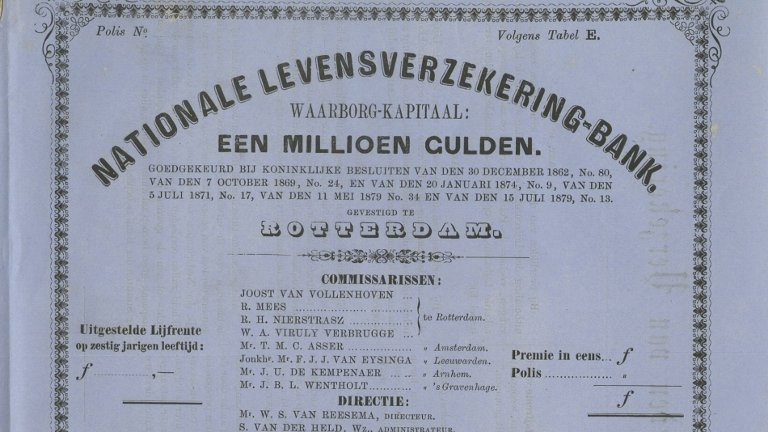

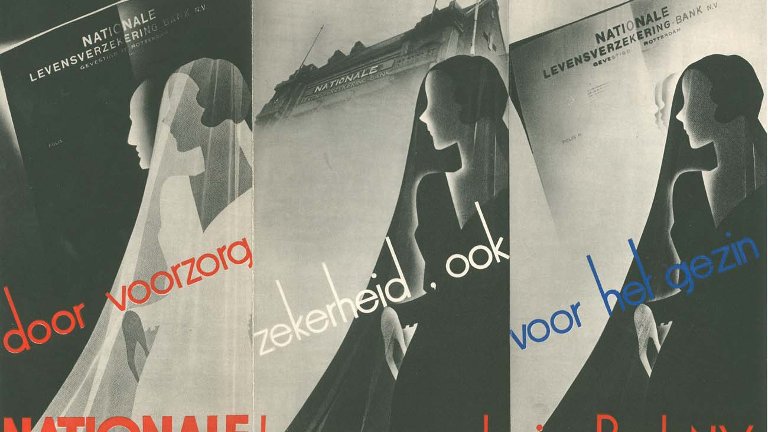

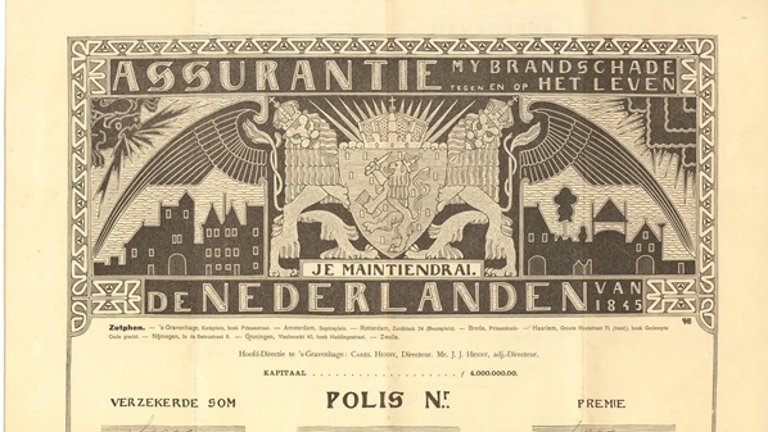

In 1845, two cousins founded De Nederlanden van 1845, a fire insurance company in Zutphen. Beyond insuring against fire and other risks, the company distinguished itself by focusing on prevention. They even established a voluntary fire brigade, entirely staffed by employees of De Nederlanden. Nearly two decades later, in 1863, the Nationale Levensverzekering-Bank was established in Rotterdam. As one of the first Dutch life insurance companies, it quickly gained recognition for its actuarial approach, skilled physicians and expert commissioners.

1857

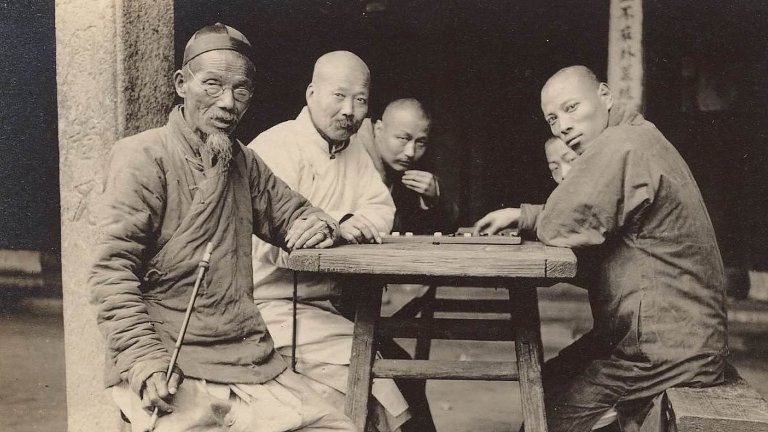

Spreading our wings

De Nederlanden was one of the first Dutch insurers to expand internationally by setting up local agencies. Its journey began in 1857 with the establishment of its first foreign agency in Batavia (now Jakarta, Indonesia), the capital of the Dutch East Indies. From there, the company expanded across Europe and eventually to other parts of the world.

1880

Social protection

Meanwhile, Nationale focused on new forms of social protection. In 1880, it introduced the first collective pension scheme in the Netherlands, providing retirement security for the employees of the Dutch Yeast and Spiritus Factory. This initiative was considered groundbreaking at the time, as other companies only started providing pensions for their employees in the early 20th century.

1900-1945 'Challenging times'

The new century brought progress through economic growth and internationalisation. However, the optimism was short-lived, as the world was soon confronted with economic depression and war. Despite this, insurance companies continued to develop, increasing the diversity of products, like car insurance, and expanding international markets.

1913

An attractive workplace

The early 20th century brought economic prosperity to the Netherlands, creating new opportunities for insurers. Life insurance companies expanded into Belgium through acquisitions, while modernising their organisations became a priority. De Nederlanden relocated its headquarters to The Hague and focused on creating an attractive workplace. Initiatives included trainings for talented colleagues, implementing a staff pension scheme, and offering holiday homes for lower-paid workers.

1930

The Great Depression

The global economic crisis of the 1930s led to mass unemployment and wage cuts. During this challenging period, insurers faced declining premium income. Nationale, recognising the hardships of low-income citizens, provided insurance to those hit hardest by the depression.

1940

The Second World War

The Second World War had an enormous impact on the Netherlands and the Dutch people. Offices of both companies were bombed and destroyed and a total of 46 employees, including many Jewish colleagues, lost their lives during the war. The Nazis forced Jewish citizens to surrender their life insurance policies. After the war, delays in payments to Holocaust survivors further compounded the injustices. In 1999, NN, together with other Dutch insurance companies, helped set up a fund to rectify past wrongs and provide reparations to the Jewish community.

1945-1990 'New times'

The Netherlands entered a period of rebuilding and economic growth after the destruction suffered during the Second World War. The insurance market continued to expand. Competition also grew, changing the dynamics of the industry.

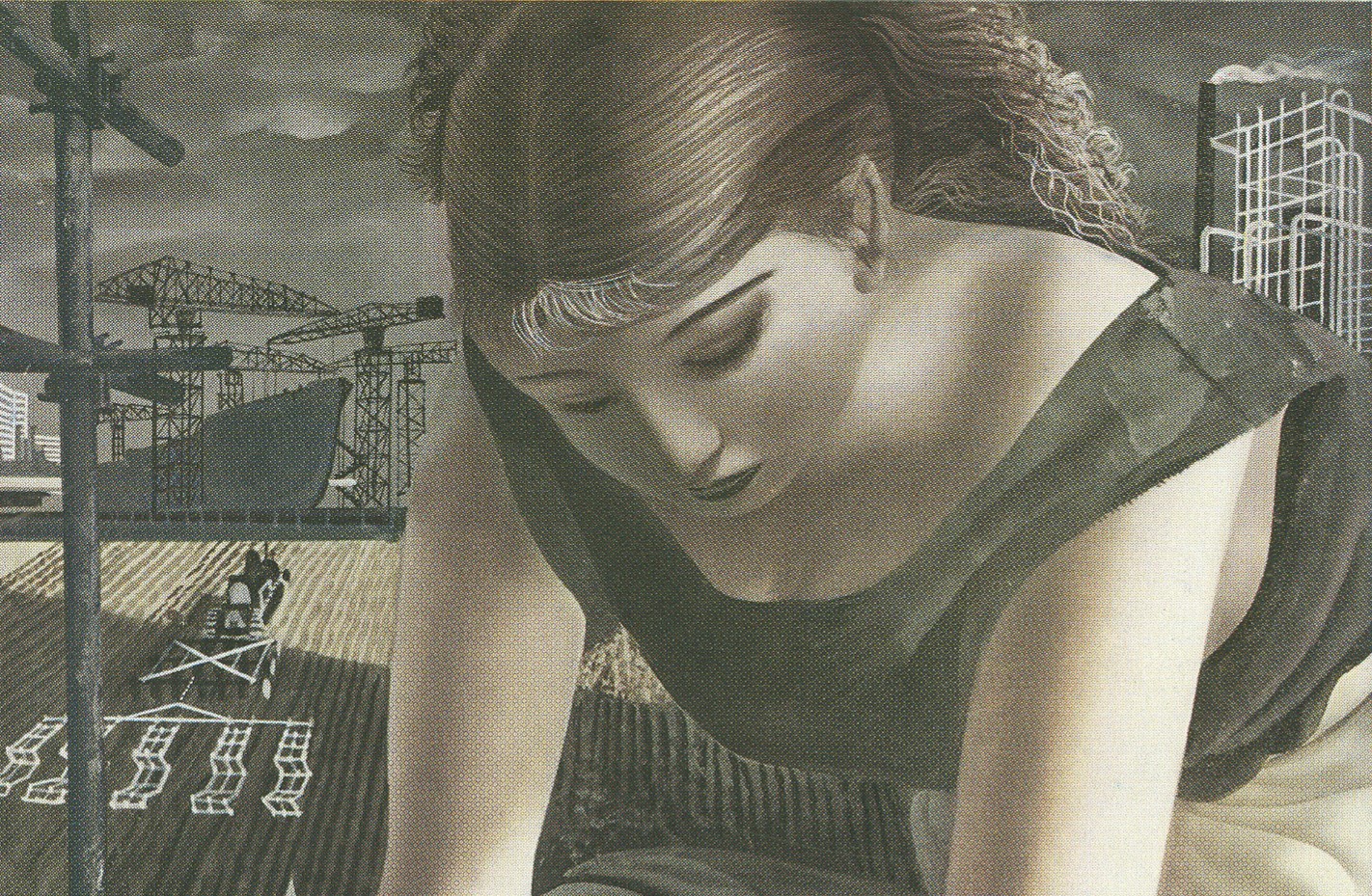

1945

Rebuilding

After the Second World War, The Netherlands started a period of reconstruction, also known as the ‘wederopbouw.’ With cities in ruins, there was an urgent need to rebuild homes, schools, factories and shopping centres. NN’s predecessors played an important role in this effort by helping to finance the construction of housing estates and key infrastructure. In addition, special insurance policies and funds were set up to support and cover the risks of reconstruction.

1963

The birth of Nationale-Nederlanden

In 1963, De Nederlanden van 1845 and the Nationale Levensverzekering-Bank merged to form Nationale-Nederlanden in response to increasing competition in the Dutch insurance market. The merger combined their strengths, creating a company with a solid domestic market position and an international focus. This union also bolstered financial strength, setting the stage for further expansion.

1964

International expansion

From the 1960s, Nationale-Nederlanden accelerated its international expansion. Moving away from working only with local agents, the company shifted its strategy to acquiring foreign companies, focusing mainly on North America and Australia—regions where many Dutch emigrants had settled after the war.

1970

Increased visibility

In 1970, Nationale-Nederlanden introduced its now-iconic orange N logo. The rebranding gave the company greater visibility through advertising but also through sports sponsorships. In 1992, Nationale-Nederlanden became the sponsor of the Dutch national soccer team.

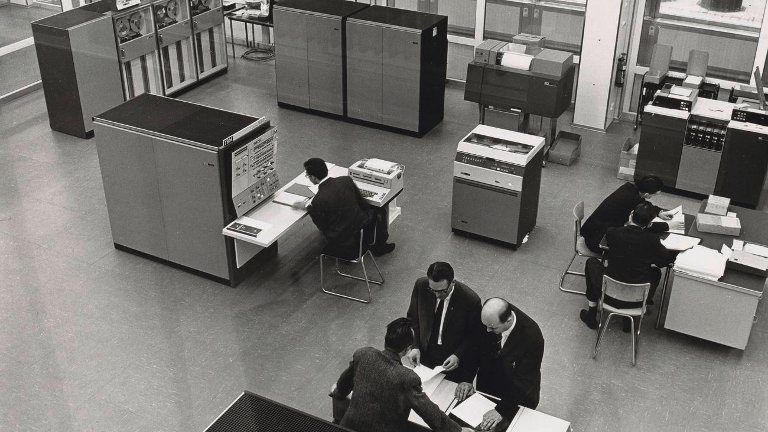

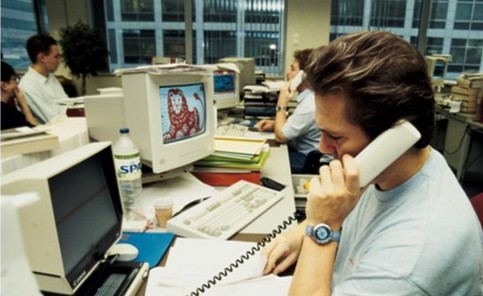

1973

Automation

The continued growth of Nationale-Nederlanden contributed to a sharp increase in administrative work, driving the need for automation. Following the purchase of the first computer in 1957, the company created its first automation department in 1973, gradually automating the most labor-intensive processes. Personal computers were introduced across the company.

1978

New markets

In the 1970s and 1980s, Nationale-Nederlanden started greenfield businesses in various markets that were opening up for life insurances and foreign investments. New offices opened in Spain and Greece, while in Japan, the company became the first European insurer admitted to the Japanese market.

1990-2014 'Changing world'

In the 1990s, the financial industry experienced a period of consolidation, with a series of mergers. However, the global financial crisis of 2008 changed everything and caused a severe economic downturn, significantly affecting the industry.

1991

ING Group

In 1991, Nationale-Nederlanden merged with the national postal bank, NMB Postbank to form the Internationale Nederlanden Group (ING). The merger provided Nationale-Nederlanden with a large additional distribution channel. Through strategic acquisitions across the US, Asia and Europe, ING grew into one of the world’s largest bancassurers. In the post-Cold War era of the early 1990s, ING launched more greenfield insurance businesses across Central Europe (Hungary, Czech Republic, Poland, Slovakia, Romania).

2008

Global financial crisis

The 2008 global financial crisis had a major impact on ING, forcing it to apply for support from the Dutch government. Partly as a result of this, the European Commission forced ING to split its banking and insurance businesses and sell certain business activities. The remaining insurance business, which now comprises activities in Europe and Japan, was renamed NN Group and prepared for a public listing.

2014 –Today 'A new beginning'

Becoming a listed company ensured that we could retain our history, whilst also paving the way for a modern business that looks positively towards the future. Our strength as an organisation meant that we could manage the upheaval of Covid 19, as a stronger more inclusive company with a clear focus on our business and societal responsibilities.

2014

A new company

On 2 July 2014, NN Group made its debut on the Amsterdam Stock Exchange, marking the start of a new company. In the following years, NN further strengthened its position in the Netherlands through acquisitions of Delta Lloyd and Vivat Non-life. Internationally, NN acquired businesses in Poland and Greece while selling its asset management business, NN Investment Partners.

2020

Contribution to society

As part of its commitment to contribute to society, NN launched its community investment programme in 2014 and published its first sustainability report. In the following years, NN took further steps in its sustainability journey. In 2020, it announced its first net-zero emissions target for its investment portfolio, later followed by targets for its insurance and mortgage portfolios.

2020

Covid-19 pandemic

NN responded swiftly to the Covid-19 pandemic in 2020, supporting the well-being of colleagues, customers, business partners, and society at large. To support customers in financial distress, NN provided extra cover for restaurants and the hospitality industry, and mortgage and consumer loan payment breaks. The pandemic accelerated existing trends in remote working and digitalisation.

2020

Inclusive workplace

To foster a more diverse and inclusive workplace, NN introduced a target for women in senior management positions. It also introduced ‘You matter’ leave, enabling colleagues to take time off for an exceptional situation, such as grieving the loss of a loved one or a transition process among others.

Historical collection

The History Department at NN Group preserves and provides access to records and permanent items of historic importance of our more than 180 years of history. The collection contains archives, advertising materials, objects and photos. We are pleased to offer you a selection of articles of some of the more remarkable items in our collection.

Historical collection

Historical collection

Engeltje, the first person insured by the Hollandsche Societeit

Historical collection

The Arithmometer - a unique calculating machine

Historical collection

Fire plates

Historical collection

Historical travel reports

Historical collection

Calendars

Historical collection

NN and Dutch architect Berlage

Historical collection

Bicycle insurance

Historical collection

The policy – an insurer’s showpiece

Historical collection

Fatum, fate

Historical collection

Office life in photos

Historical collection

Car insurance

Historical collection

The Insurance Game

Historical collection

Advertising film from De Nederlanden van 1845 in 1939

Historical collection

Remembering our employees, 1940-1945

Historical collection

Coffee at the office

Historical collection